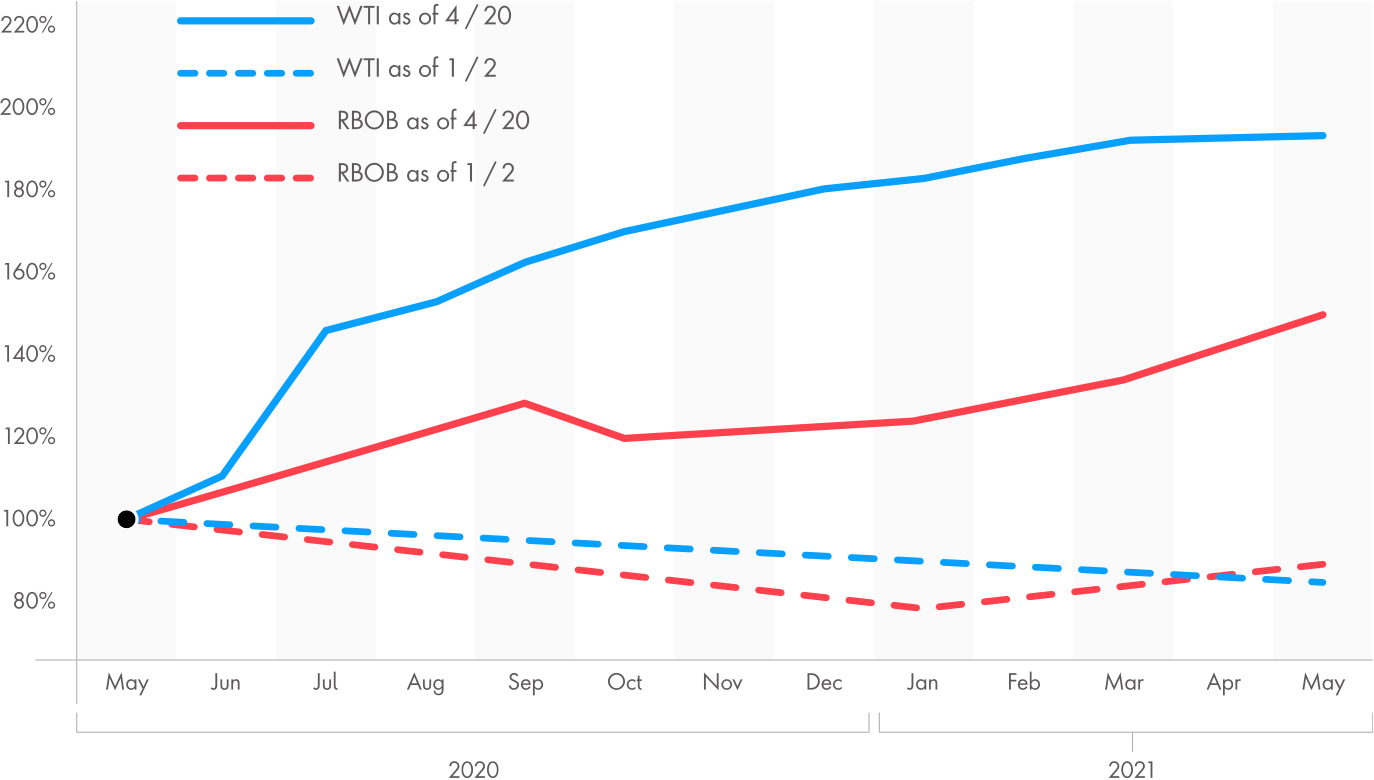

The Covid-19 pandemic has been the most disruptive force to the world economy in recent history: external, unpredictable and well outside most of our experience. While prior economic disruptions could be explained by unsustainable economic growth, geopolitical problems, or new technology proliferation, the pandemic has come ‘out of nowhere’ and every one of us is affected by its impact.

Insight

{{eyebrowContentTitle ? eyebrowContentTitle : activeTagName}}

Guide to Next 2025 Industry Trends Report Guide to Next 2025 Industry Trends Report Guide to Next 2025 Industry Trends Report Guide to Next 2025 Industry Trends Report

Curious about what the future holds for your industry? Get ahead with our expert insights and trend reports that reveal the top strategies for success in 2025.