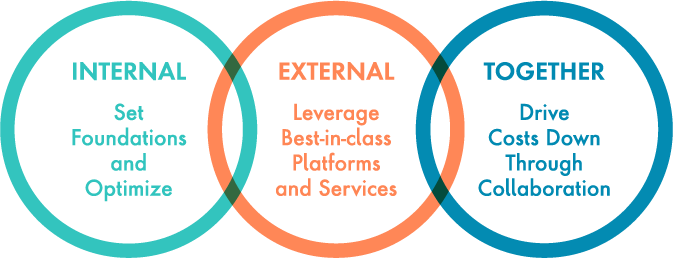

In a post-Covid period of accelerated change, where patterns of energy use are shifting and countries are pushing the energy transition agenda, companies need to become more agile. This requires IT systems that are quicker and cheaper to adapt to the new environment along with a new approach to technology development based on collaboration with industry peers in areas of common interest.

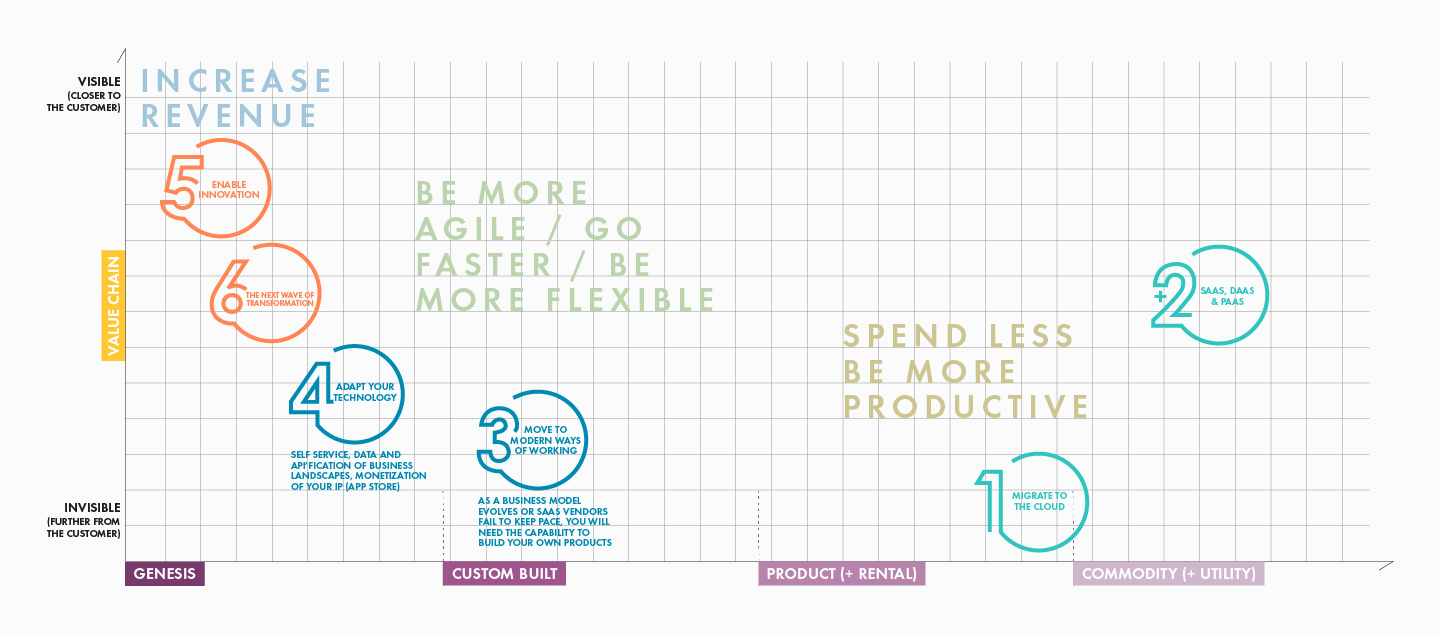

Energy companies are taking important steps to update their technology already. They are investing in the essential foundations of a modern architecture: migrating to the Cloud and switching to SaaS, platform and data services.

Though crucial, these are just the “standard-issue” cost reduction and efficiency enablers that everyone is deploying. They confer no sustainable competitive advantage. Beyond them, however, lies another opportunity that the industry is currently missing – one that offers huge potential gains if energy companies are prepared to change the way they think about their IT needs and challenges.

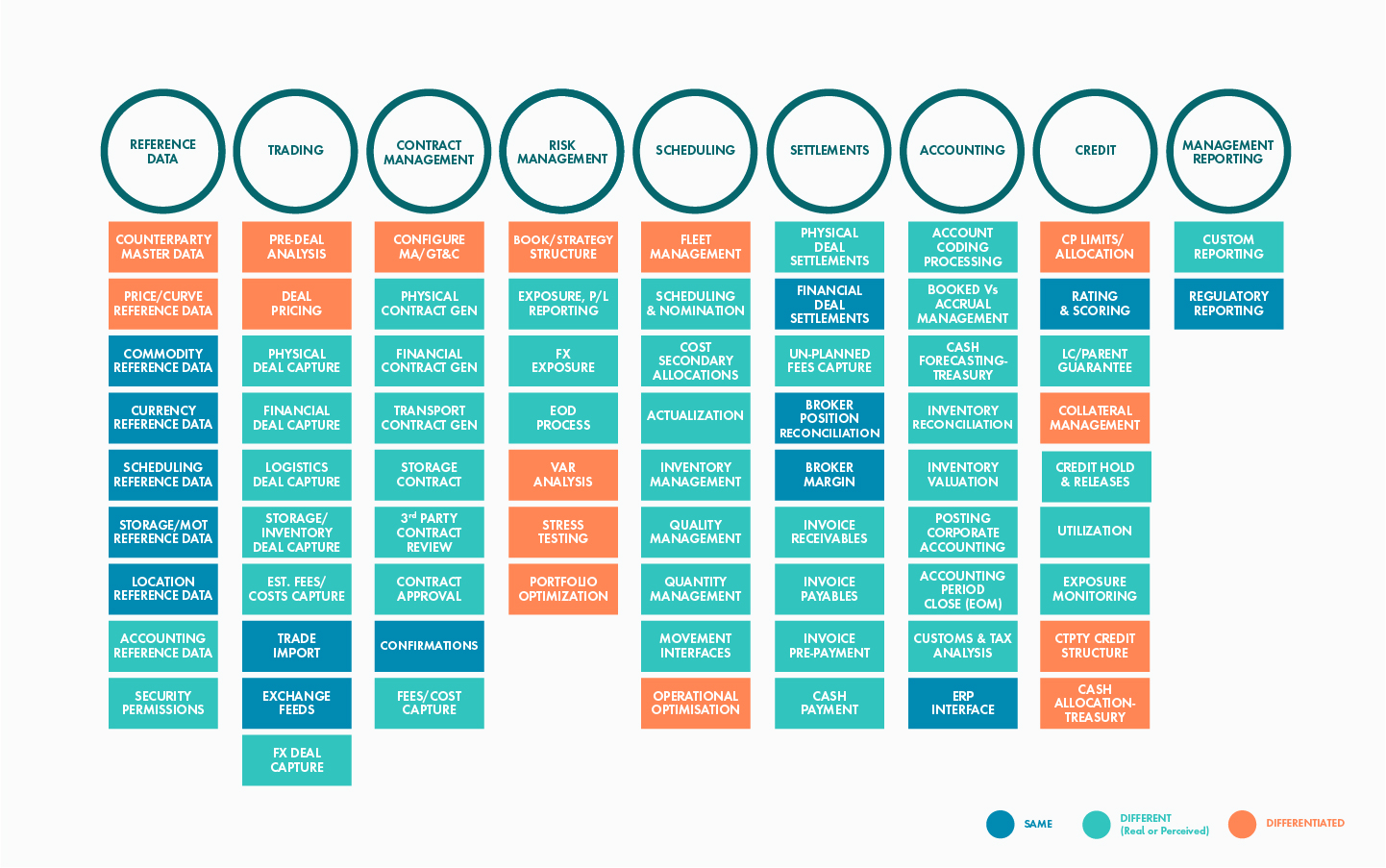

The answer, in a word, is collaboration. This is not an idea that gets much airtime in energy trading today – but it should. Although energy companies might believe they have a lot of proprietary IP tied up in their energy trading and risk management systems, in reality there is far less than they think.

Many of the operations they perform and the tools they use are undifferentiated with no unique competitive edge. These companies have a lot more in common than they might realize and share many of the same IT challenges – collaborating to tackle them and achieve common standards in areas where it makes sense could deliver major upsides for everyone.