E-commerce profitability has been an ongoing struggle for most retailers since the acceleration of online shopping during COVID-19. According to a Publicis Sapient and Salesforce survey, 9 in 10 retail decision-makers claim to know what’s needed to improve e-commerce profitability, yet half struggle to deliver.

53% of retailers believe that increasing investment in digital customer experience will increase profits. But when it comes to investing in supply chain modernization, only 43% say the same. It may be time for retailers to change their investment strategy.

“We’ve seen retailers across sectors build customer loyalty by significantly improving their e-commerce websites and omnichannel engagement strategy,” says Frans Van de Schootbrugge, director of agile program management at Publicis Sapient. “But they lose that goodwill just as quickly by not being able to fulfill online orders to customer expectation.”

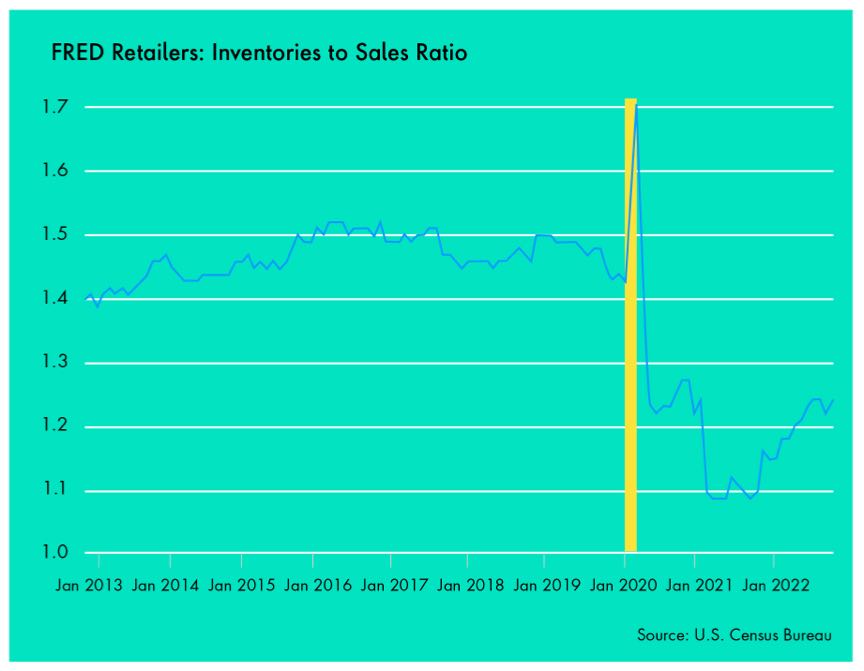

During times of economic uncertainty, this issue becomes even more pronounced. As customers tighten their purse strings, retailers are forced to find long-term solutions.

Why retailers need to prioritize investment in back-end operations

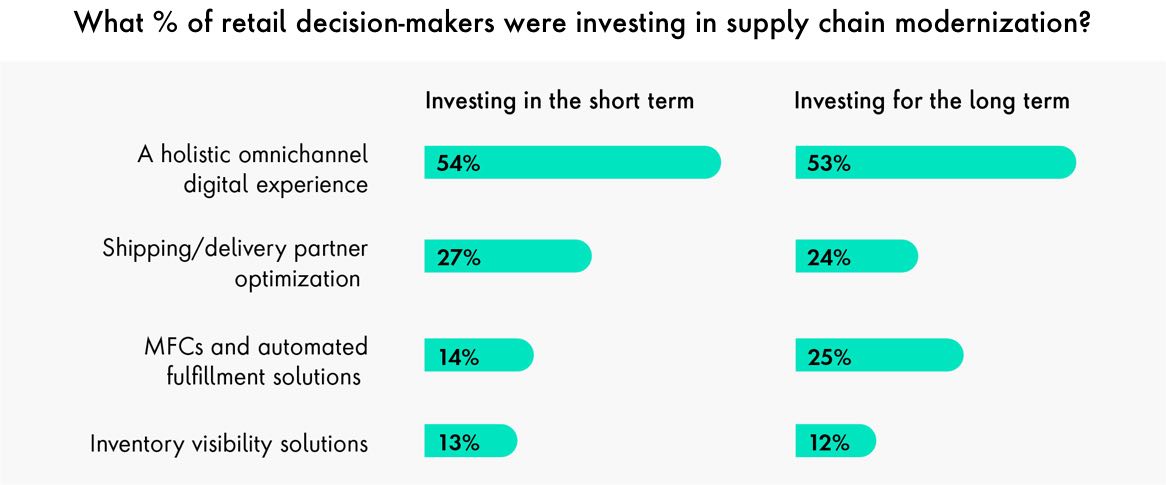

In early 2022, retail decision-makers prioritized investment in a holistic omnichannel experience to meet customer expectations rather than the underlying infrastructure, including shipping and delivery partner optimization, automated fulfillment solutions, and inventory visibility solutions.