The days of a gas station’s role as a convenient fuel stop are numbered. Changing consumer expectations, market economics and shifting competitive dynamics mean that oil companies and pure fuel retailers are under pressure to reinvent the gas station as part of their overall digital business transformation.

Attitudes have changed. Today’s consumers are all about choice. They are looking to find the best value not only for their vehicle but also for themselves. Purchases must be experiential. Convenience, location or price and consumers’ perception of a brand, influenced by their interaction with it, all compete to affect their purchasing power. And in an automated, digital future where even the driver may not be behind the wheel, there is an imperative to modernize.

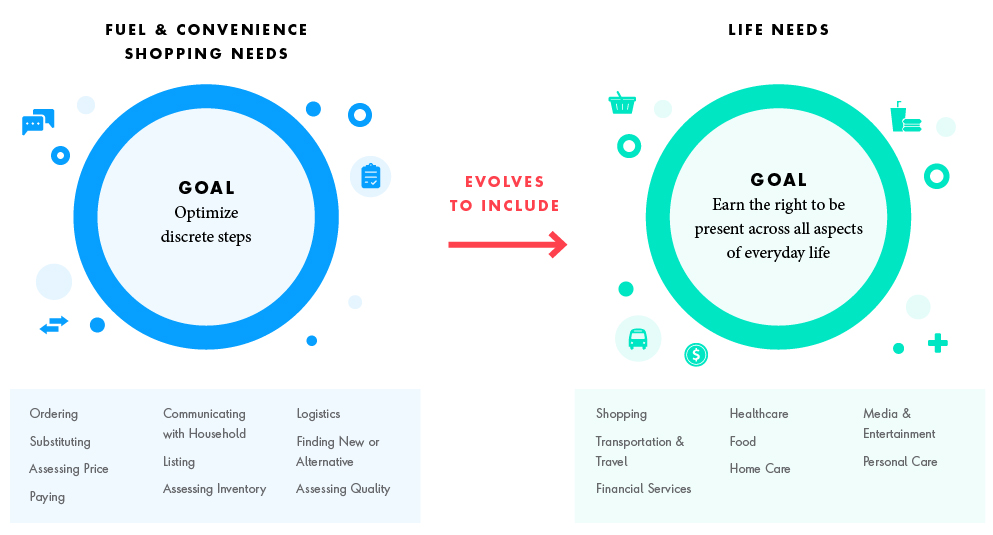

What is involved? Fuel retailers must modernize the consumer experience—by offering fuel, as well as convenience shopping, providing additional services, and even addressing future needs, such as what consumers do while their electric cars are charging. And they must modernize consumer engagement—by offering a destination of choice and influencing consumers through the general ambience, loyalty schemes, and apps that lock in consumer preferences.

The drive to transform

Fuel retailers must take account of the economic value and competitive advantage of their infrastructure and physical facility, as well as embracing changing consumer needs. When The Globe and Mail reported on Twitter feedback around what women would do if “for 24 hours there were no men," self-service gas stations were featured in several of the 10,000 replies that were received. One woman said: “Gas up my car without needing a passenger/witness” with similar comments implying that safety is a factor in their choice of fuel stop.1

Let’s take a look at the pressures to transform fuel retail in more detail:

Consumers expect more and define what good looks like

If prompted about their retail fuel experience, vehicle drivers would probably suggest that gas stations were more a place to endure than enjoy. The quality and offerings at gas stations vary, and there is often a poor perception of brand and quality. Stopover stations often fail to meet the needs of consumers, whether they are on a short journey or a longer road trip. Fuel brand is almost immaterial to these buyers; visiting a fuel retailer is based on price, location or simply convenience.