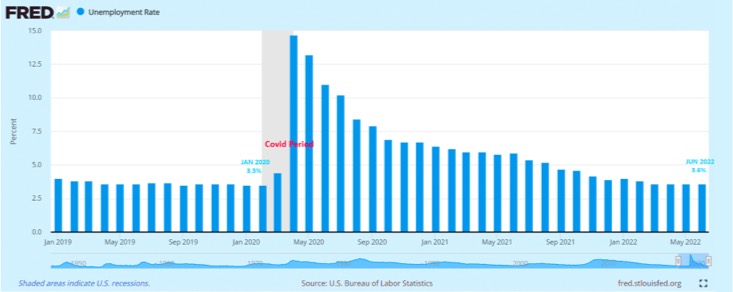

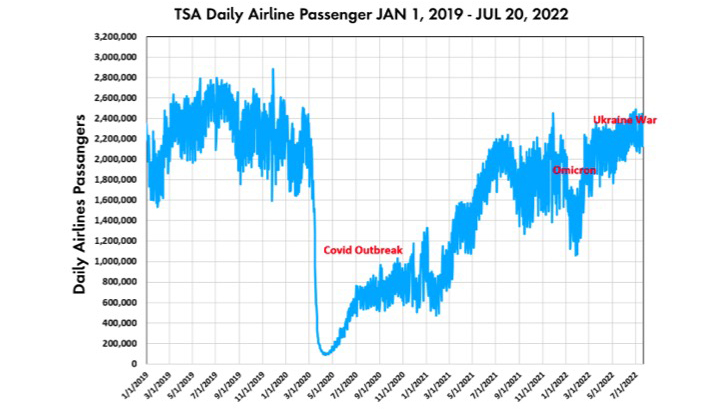

Travel demand is up despite COVID-19 and now inflation. But what does a predicted recession mean for hotels and airlines, and how can brands best position themselves for an economic slowdown? Let’s dive in.

A resurgence in travel has defined the summer of 2022 for the travel and hospitality industry. However, an ongoing travel rebound into 2023 may not pan out as expected.

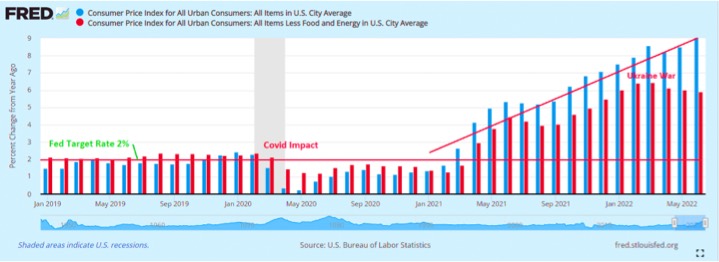

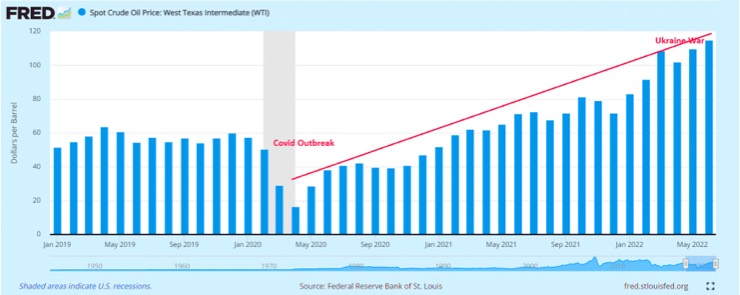

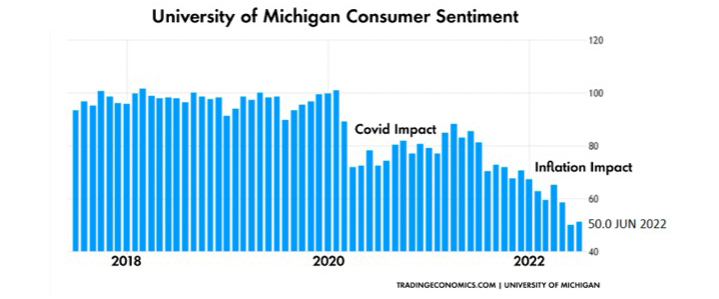

We have all become familiar with the recent impact of inflation. However, according to economists, a rare scenario defined as stagflation may be on the horizon. But the travel industry doesn’t need to worry just yet—so far, inflation alone hasn’t slowed travel down.

In fact, in addition to full domestic flights, consumers are back to taking international summer vacations, even amidst cost increases of up to 42%.

Unfortunately, there are growing concerns that this demand might slow, as some economists and financial leaders are now predicting a recession as early as 2023.

There’s also growing sentiment we may see a rare combination of two or more quarters of negative GDP growth, defined as a recession. This outcome, combined with inflation, would create a stagflation environment in the U.S. that we haven’t seen since the 1970s.

Whether we continue to see ongoing inflation or enter further into a stagflationary period, either scenario could shake up the predicted road to recovery for travel brands, depending on exactly how economic conditions play out.