Transportation & Mobility

Boosting Automotive Lifecycle Earnings through OEM Business Optimization

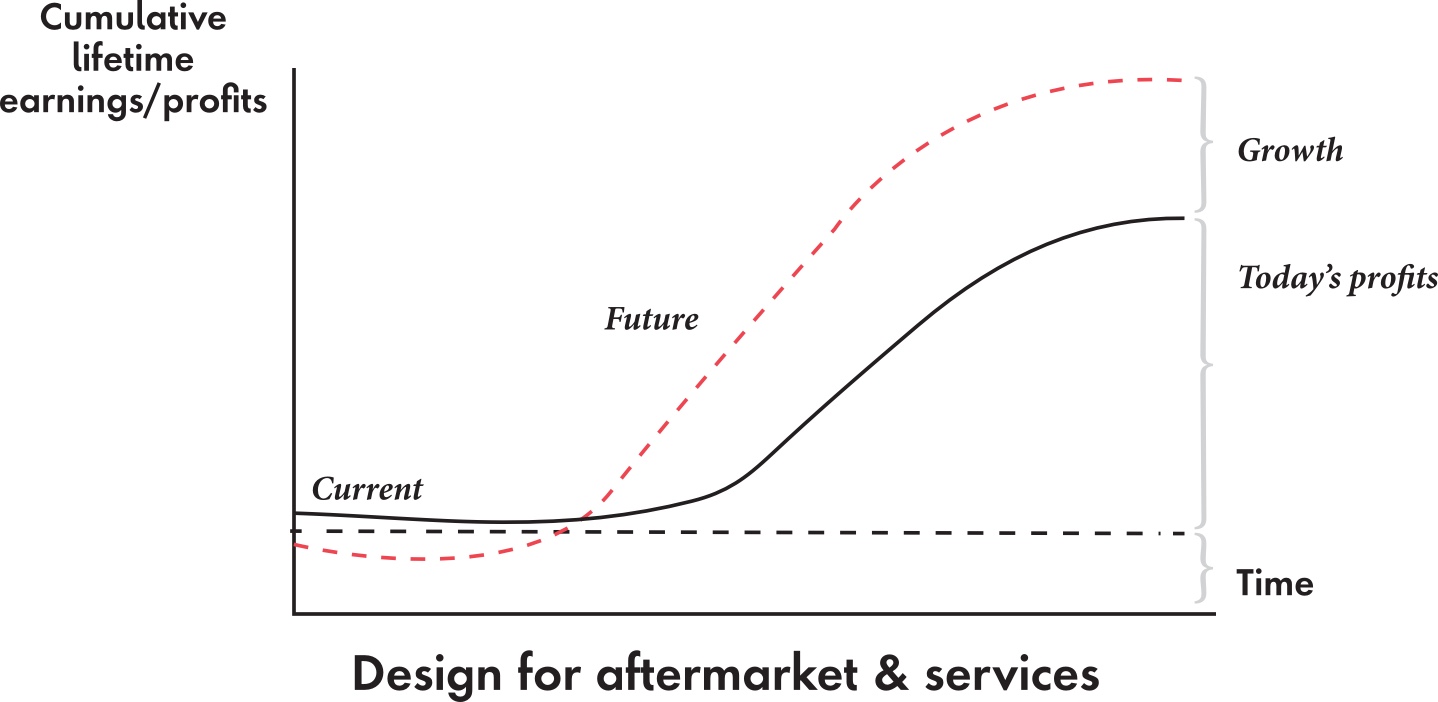

Original equipment manufacturers (OEMs) must optimize their business to stay profitable, but few have cracked the code on how to perfect a profitable automotive lifecycle through a strategic combination of customer and product value in the complex automotive ecosystem. OEMs in the U.S. are primarily focused on selling vehicles to the consumer through a dealership model and optimizing all aspects of the sale to boost profitability. Aftermarket profit is considered a bonus. In Europe, OEMs are experimenting with selling direct to consumers. But worldwide, OEMs are missing opportunities to move beyond the sale to optimize profitability across product and customer lifecycles.

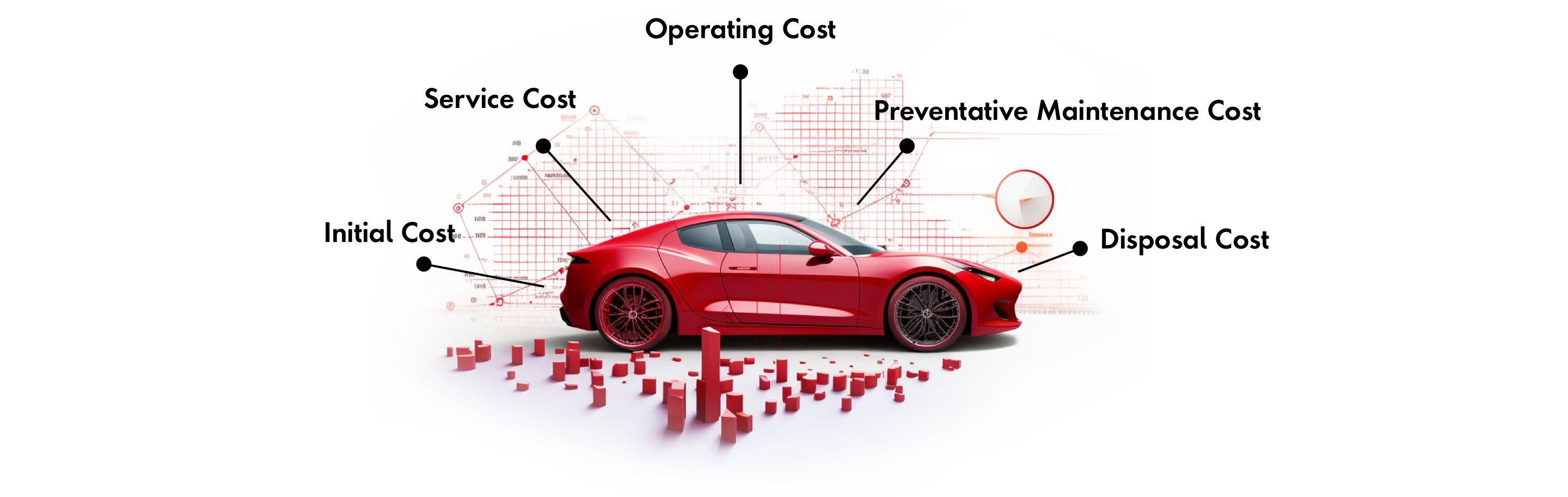

A major key to unlocking value is data. OEMs need the right tools to capture and synthesize data to make better data-driven decisions across different areas of the value chain. Technology tools can help OEMs optimize two key factors: Product profitability over time, or the lifecycle earnings and costs of a unique car or vehicle, and customer profitability over time, or the lifecycle earnings and costs of a customer’s interaction with the OEM. Combined, OEMs can find long-term success through profitable lifecycle earnings.

As OEMs move into new business models for electric vehicles and service content, the need to manage profitability over time increases. Having the right tools can help OEMs maximize the profitability of a portfolio, as well as tailor the portfolio to different markets.

But the journey begins with understanding how to explore the key areas that drive lifecycle earnings.