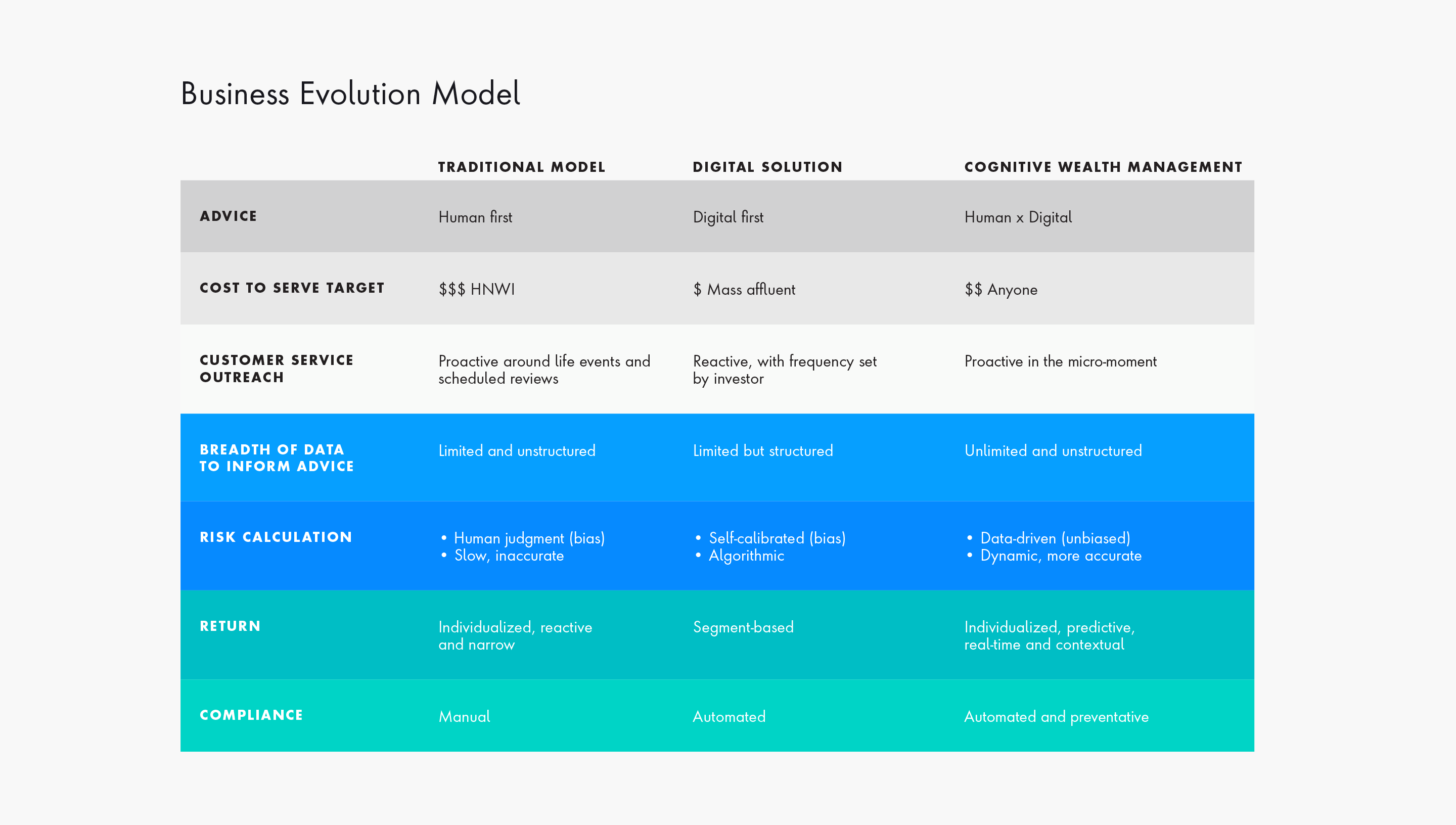

Uniting human skills and digital platforms to provide next generation financial advice

In July 2016, BI Intelligence released a forecast predicting that roboadvisors—digital tools that provide portfolio management and investment services with minimal human oversight—would manage $8 trillion in assets globally by 2020. These tools were touted as one way to reduce the cost to serve by assessing client risk tolerance and formulating individual investment plans more quickly and accurately than traditional investment models. In fact, the opportunity presented by roboadvisors appeared so great that some analysts predicted pure digital platforms would eventually emerge as the industry norm, thus greatly reducing the role of human advisors or even eliminating such positions.

While roboadvisors have their advantages—and indeed many financial service providers have adopted the use of these tools to support customer service, assess risk and formulate investment recommendations—one major obstacle to a pure digital platform has emerged: the investor. As financial organizations sought to improve the customer experience through technology, it appeared that some failed to consider the preferences and perceptions of consumers, the vast majority of whom are uncomfortable with entrusting their most important financial decisions to computer programs and advanced algorithms.

Publicis Sapient, a digital transformation partner to some of the world’s leading financial institutions, recently conducted a study of 235 retail investors to gauge their attitudes about digital investment platforms. It confirmed that while many people are comfortable with the use of AI to inform their investments, the vast majority are not willing to allow a robot to perform decisions without human oversight. For example, three out of four investors agree that a roboadvisor can perform some tasks, such as explaining option differences. On the other hand, just 28 percent of investors are willing to let an AI-enabled platform manage or rebalance accounts.