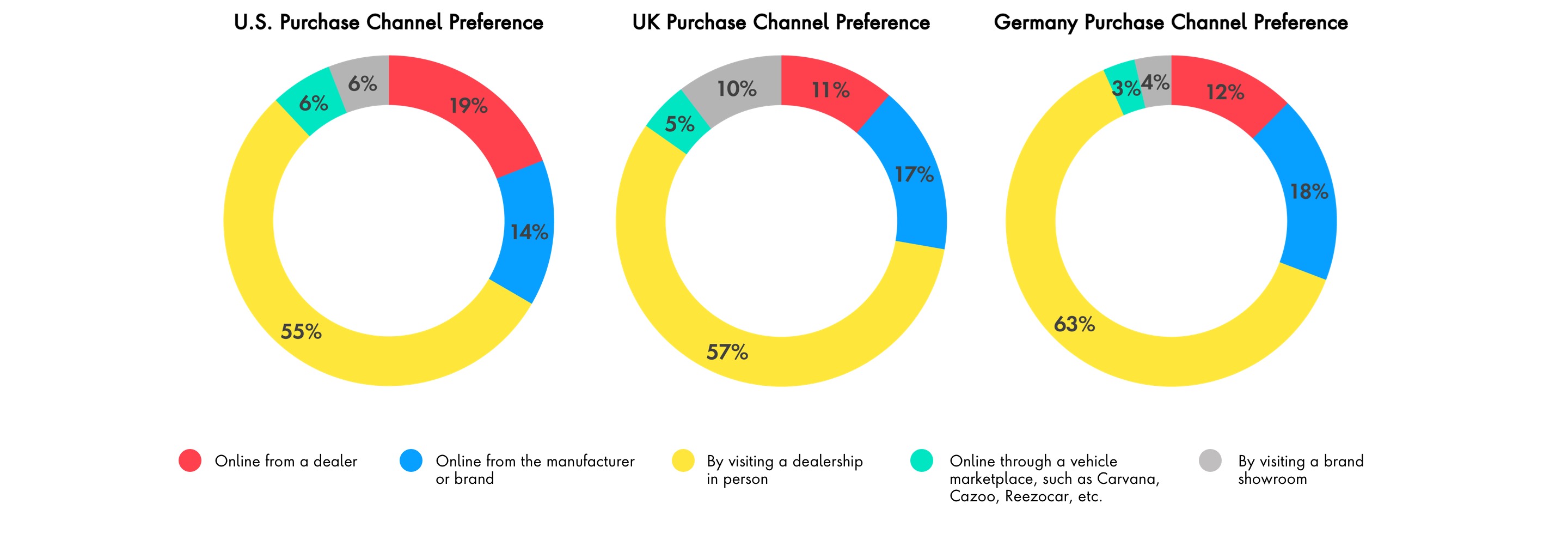

In the current model, captives are beholden to dealers as the main sales channel. Publicis Sapient’s Digital Life Index indicates that most people still prefer to complete the majority of the car buying process at the dealership, but there is ample opportunity for captives to improve the experience. In person, captives can provide various digital processes and services to aid both the dealer and the customer beyond financing to include things like inventory management and loan advice. This can not only build trust with customers, but relieve the anxiety that comes with negotiating, navigating incentives, accounting for fees and taking on monthly payments.

Further, vehicles themselves are only 30 percent of the automotive value chain—the rest consists of services, software, data monetization and other digital or non-tangible offerings. These new services along with traditional test drives and in-depth spec conversations can help dealerships—by way of the captive—provide a new source of customer value.

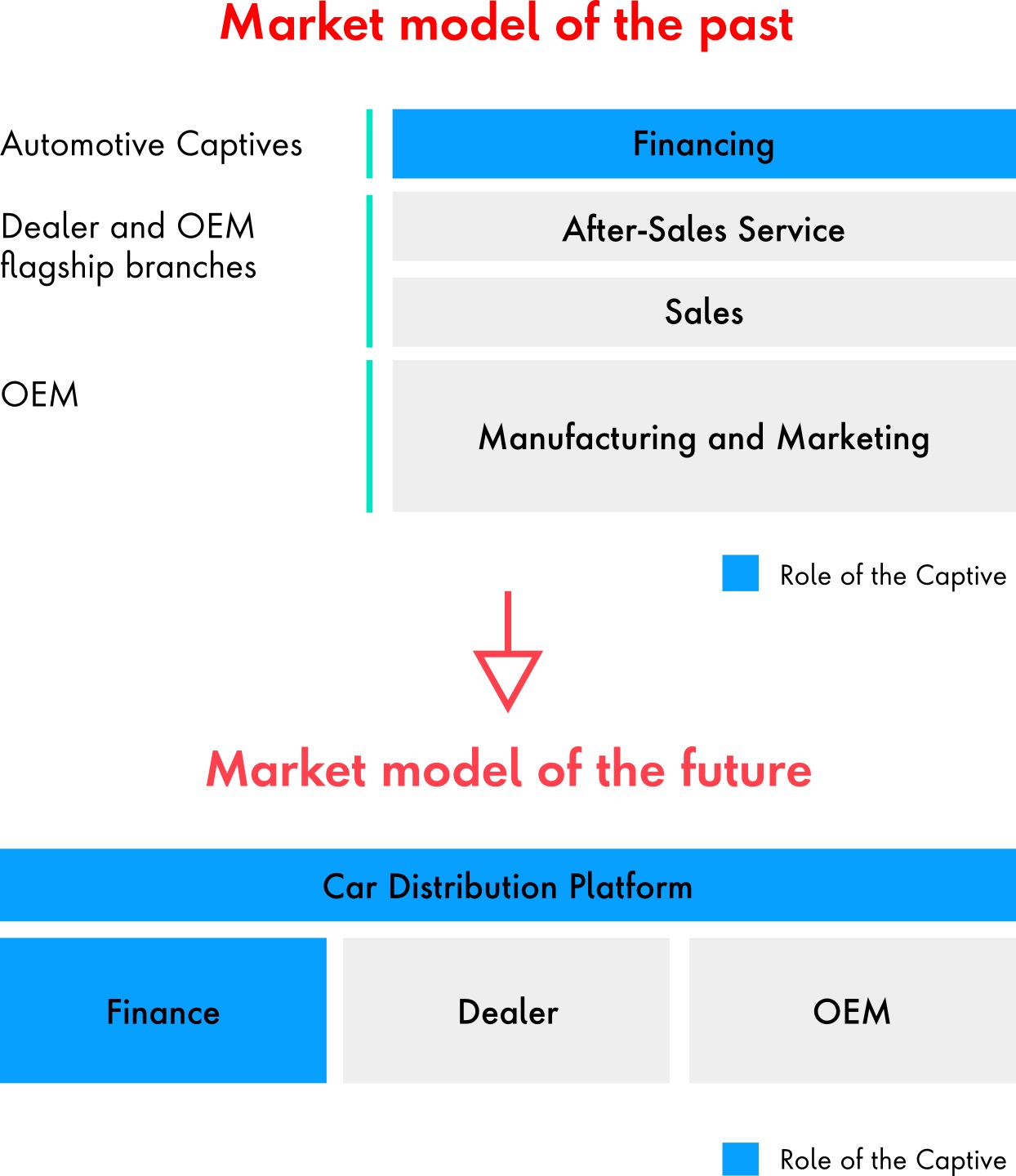

In the new model, finance captives are at the center of the automotive ecosystem, connecting available inventory with buyers, service bundling and financing through centralized data, a customer engagement platform and a re-imagined sales model.