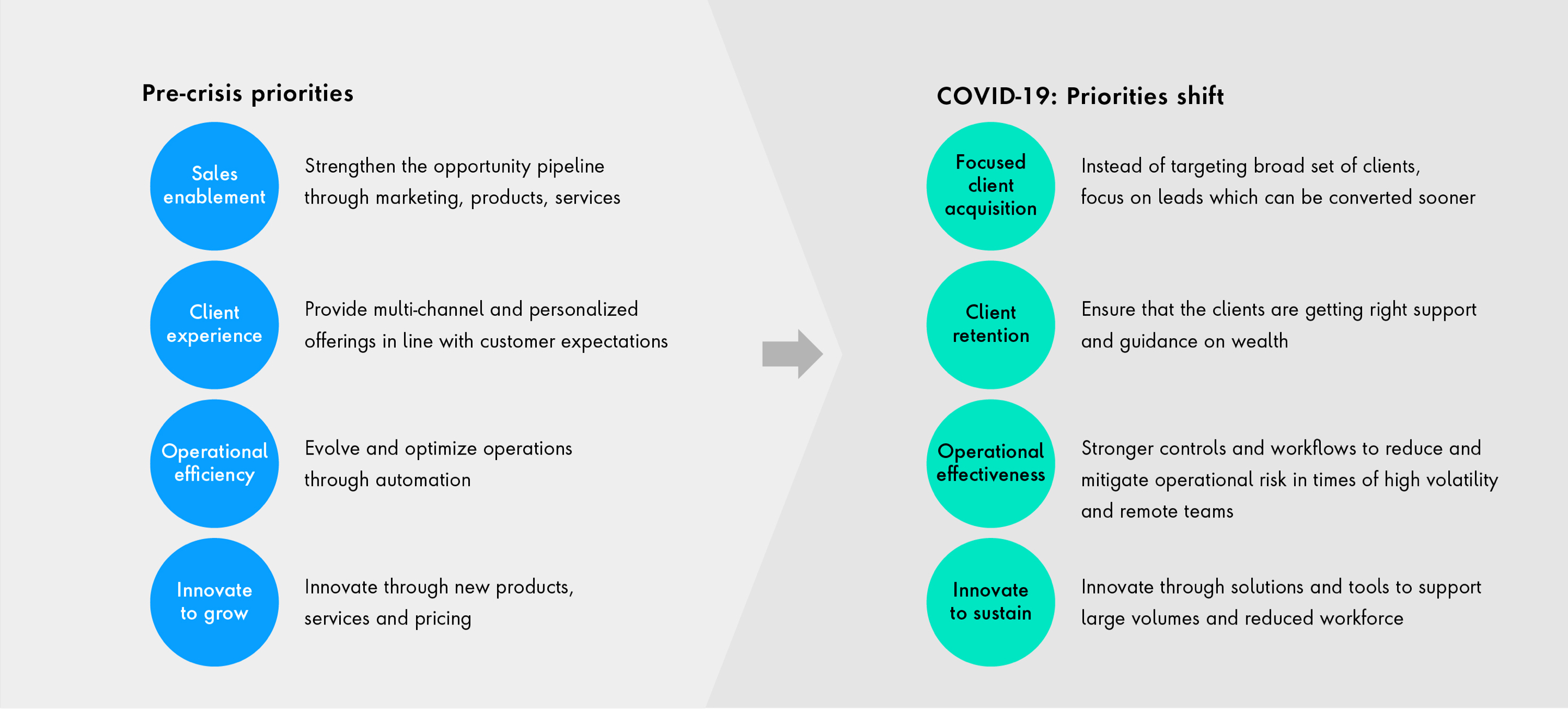

First and foremost, the COVID-19 pandemic has had a devastating impact on hundreds of thousands of lives. It has also disrupted business as usual for countless professions throughout the world. Virtually everyone is worried about financial stability with both assets and incomes in jeopardy.

According to the World Trade Organization, global trade is expected to decline between 13 and 32 percent in 2020. The United Nations’ labor agency estimates that the crisis will erase roughly 6.7 percent of global working hours in the second quarter of 2020. That’s equivalent to 195 million full-time workers.

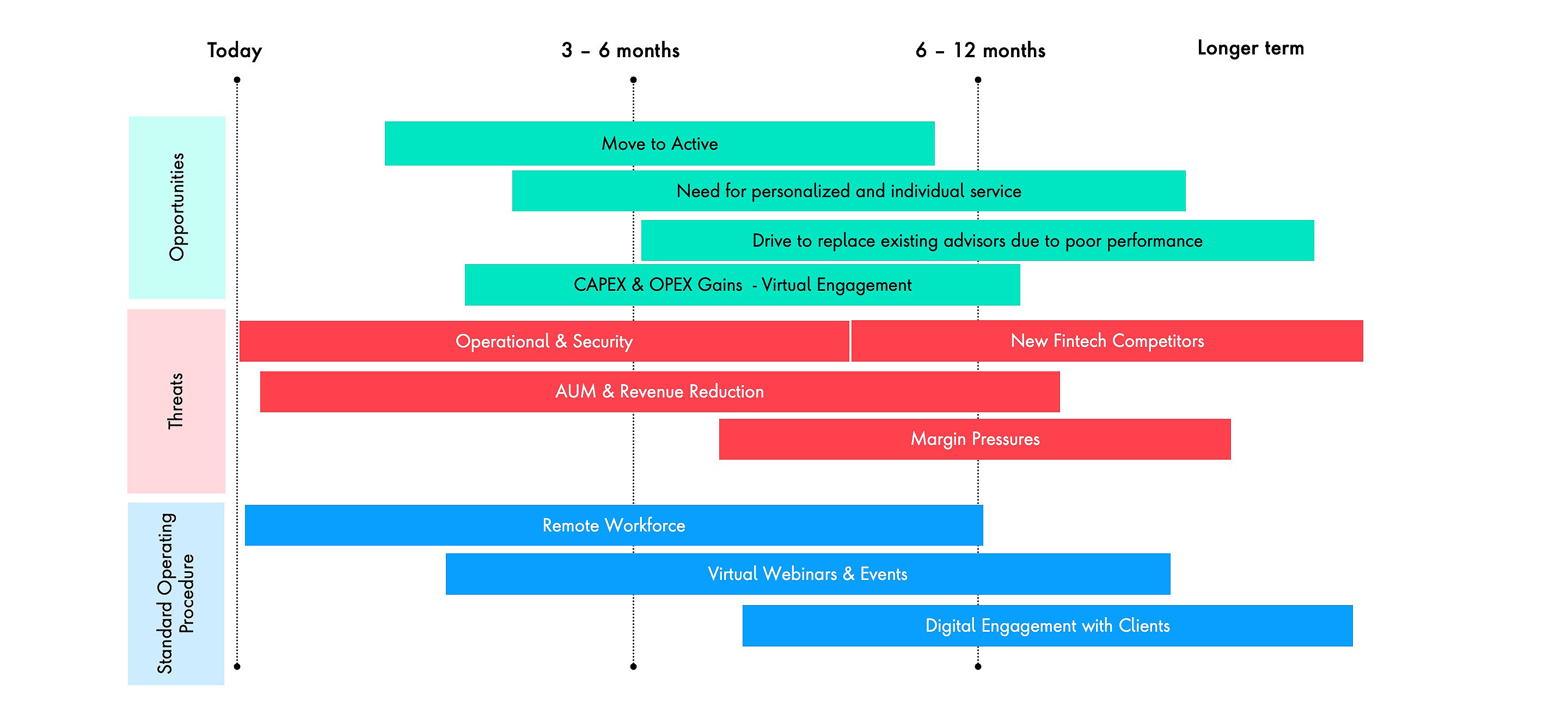

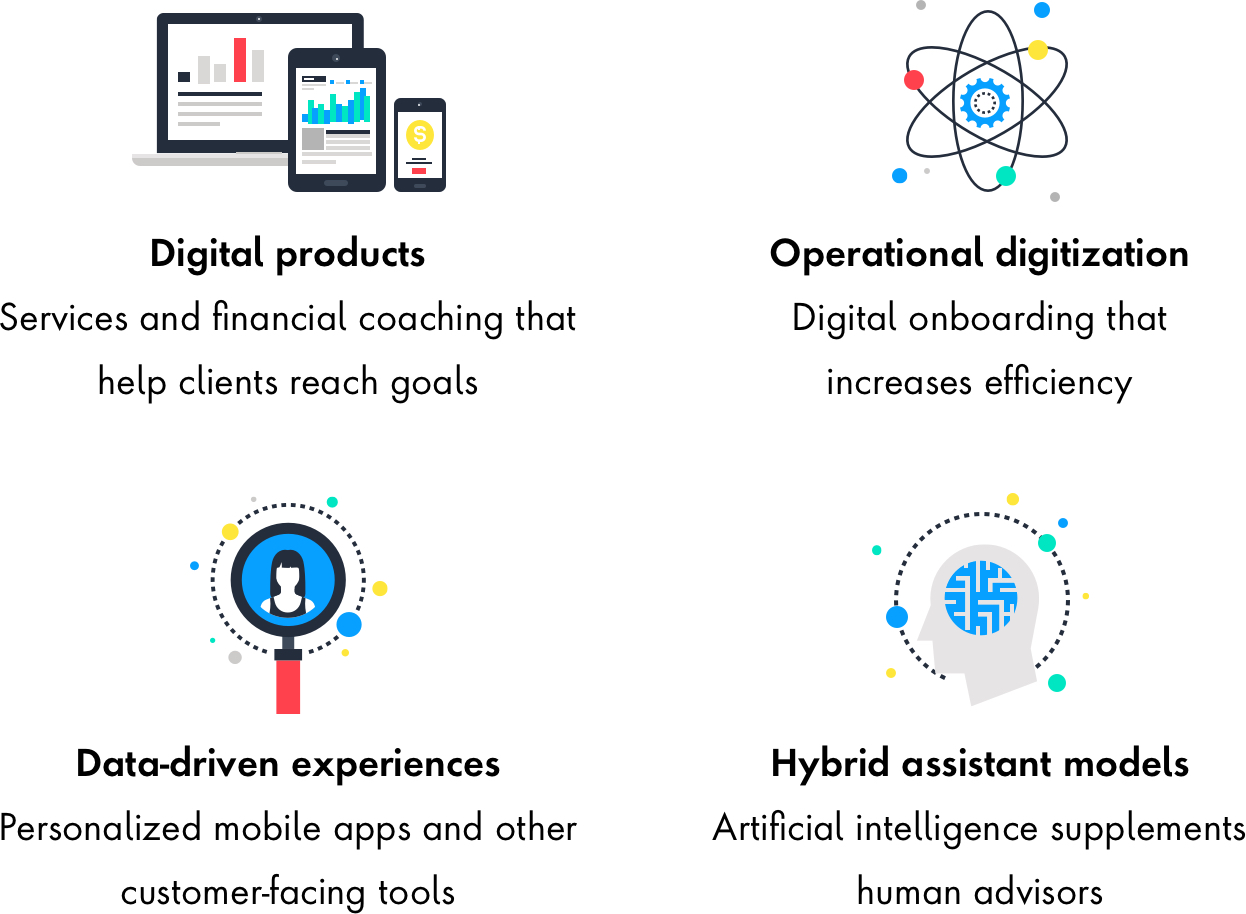

With social distancing measures in place, the importance of digital business transformation has never been clearer. Digitally enabled businesses have been able to continue servicing customers, whereas digital laggards have been brought to a standstill. This juxtaposition has reinforced the urgency of digital transformation for business operations, but it’s just as important for wealth management.