Established financial institutions need to target the right people at the right time. But truly seizing the opportunity in this space will require hyper-personalization.

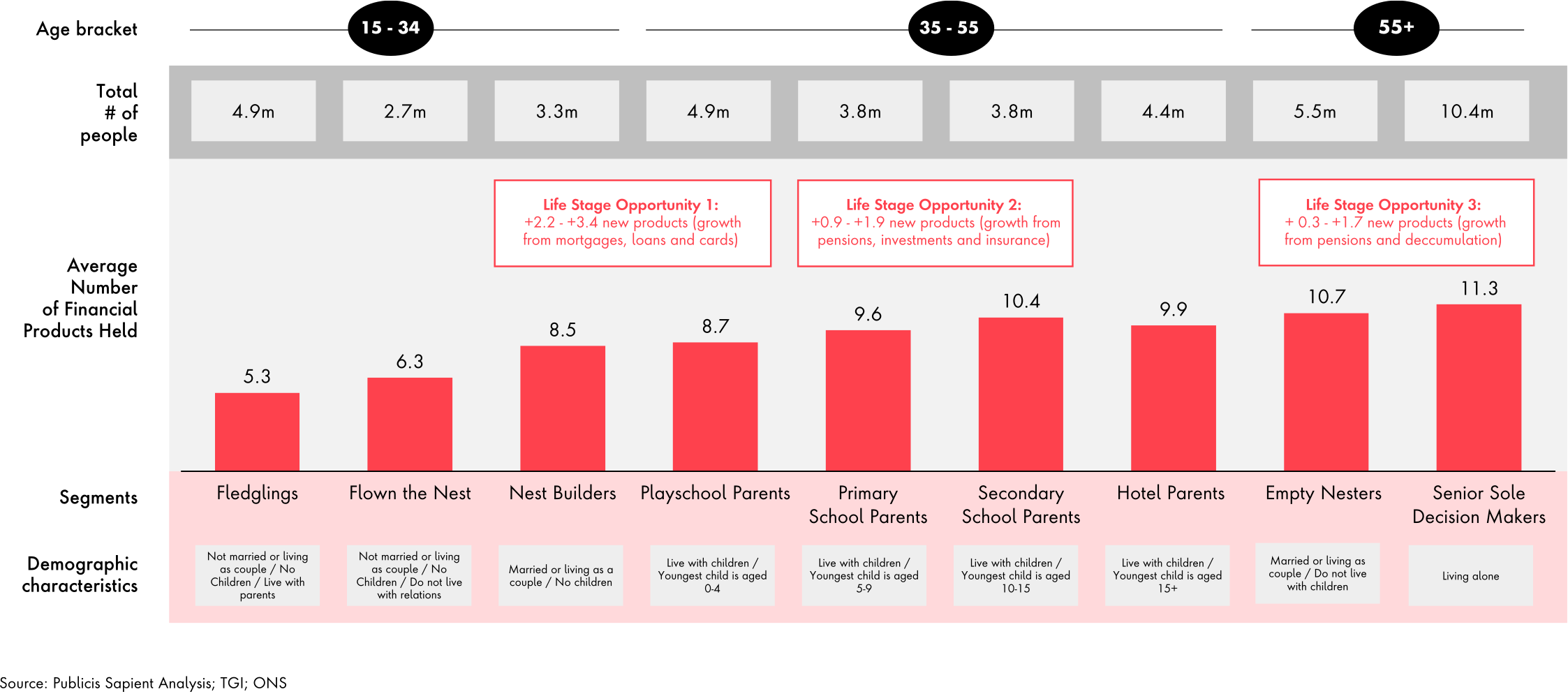

Most banking customers don’t think much about the industry unless they’ve reached a crossroads where they need a particular service. That means few people are actively looking to switch banks or are particularly susceptible to traditional marketing tactics.

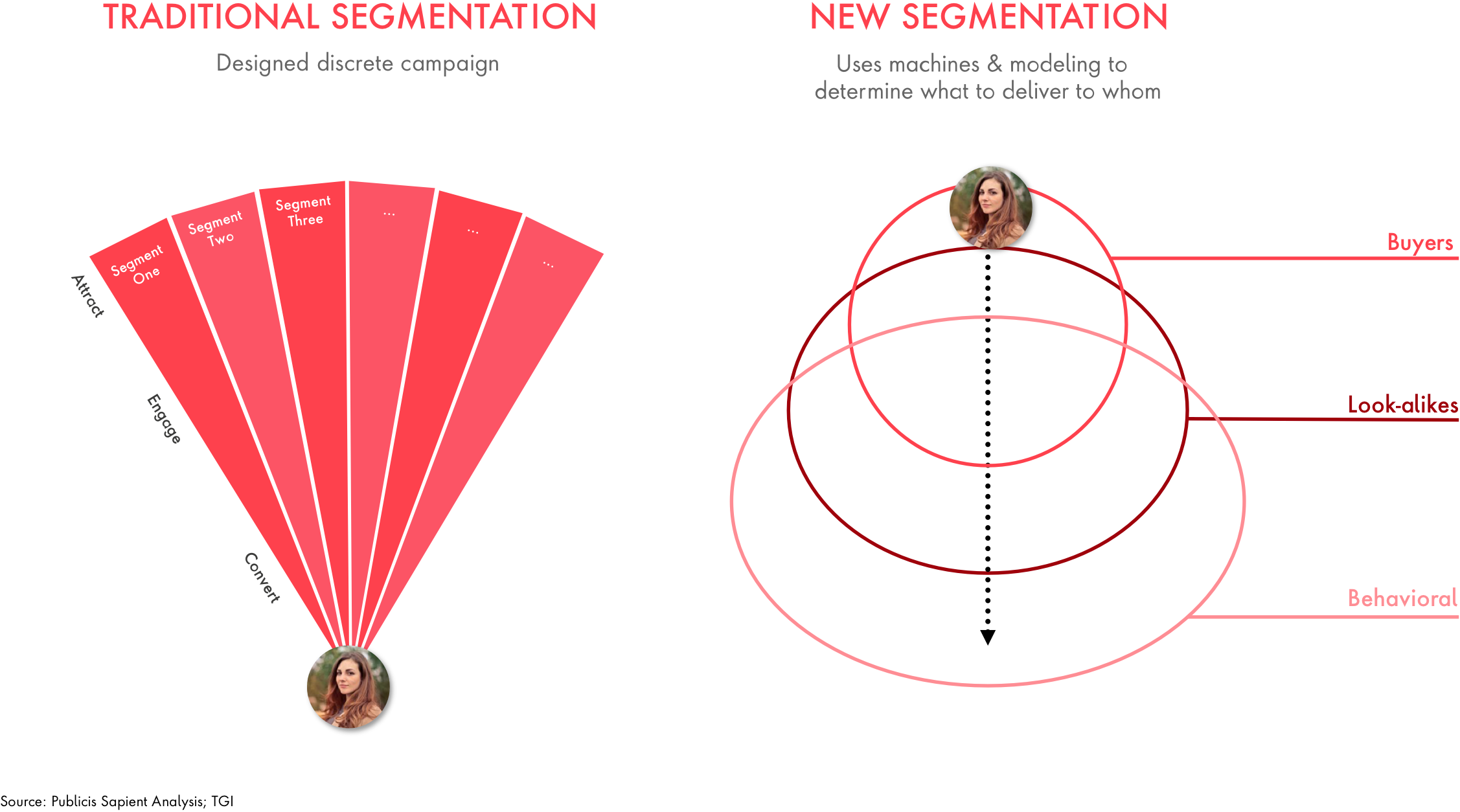

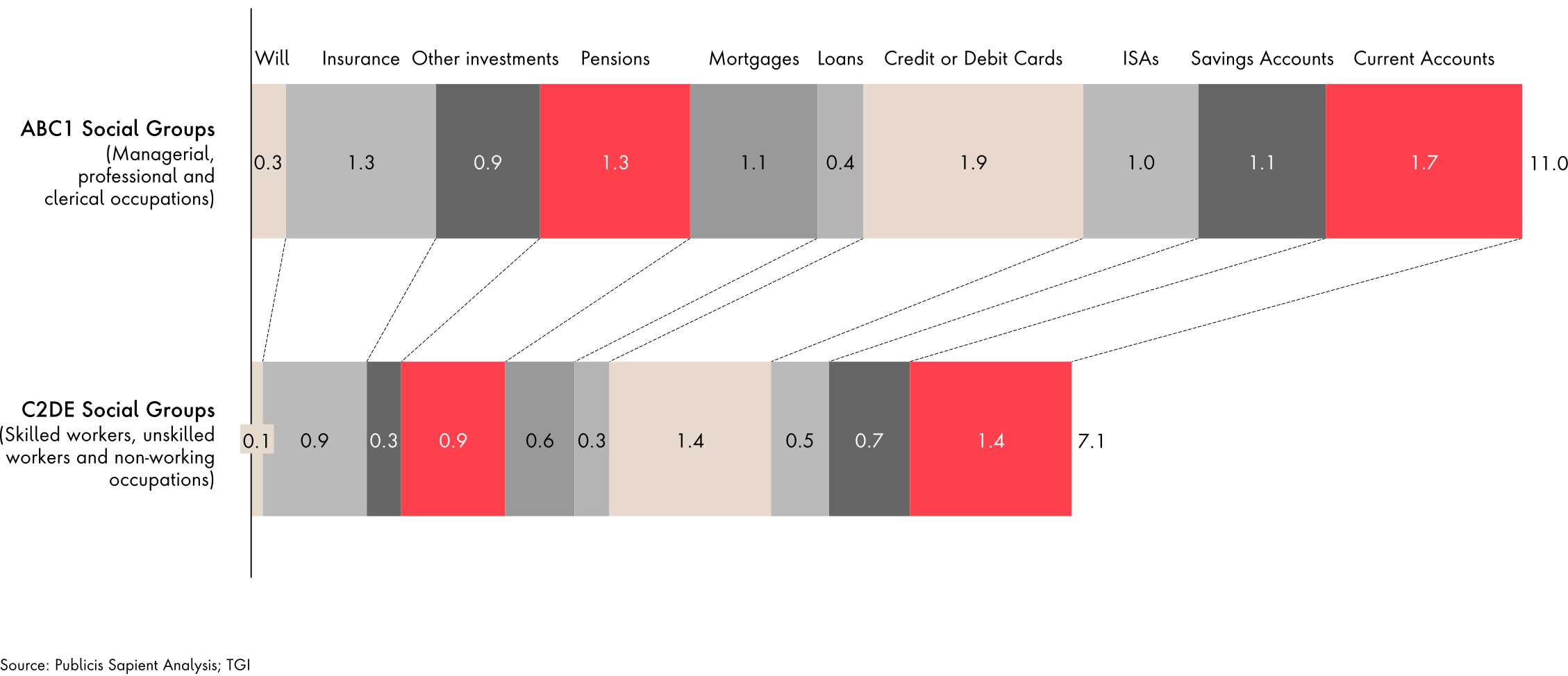

If banking customers only think about switching providers at certain times in their lives, it’s vitally important for financial institutions to leverage data for a holistic view of potential clients.

That way banks can avoid wasting time and energy marketing to people at the wrong time. They can target the right individuals when it counts. And they can approach potential customers with a personal touch.

Customer acquisition

In efforts to encourage competition and increase customer churn, the United Kingdom’s open banking and the European Union's updated Payment Services Directive (PSD2) have compelled banks to open up their data. There has also been a steady stream of new fintech entrants. Nothing helped.

The low level of customer churn creates a challenge in finding new customers.

Banks that have successfully drawn new customers have spent mightily to do so. For example, in the UK, three established, non-fintech institutions (Nationwide, HSBC and NatWest) actually expanded their list of active accounts in 2019. Each of these institutions offered £100 to £200 incentives to buy customer attention.

In 2019, the UK retail banking industry spent £233 million on conventional, above-the-line advertising: TV, radio, billboards, online ads, etc. Rather than this blunt force approach, there must be more efficient ways.

Banks would be able to offer compelling enough reasons for potential customers to ditch their current providers and open new accounts – if they know a bit about what those people need.

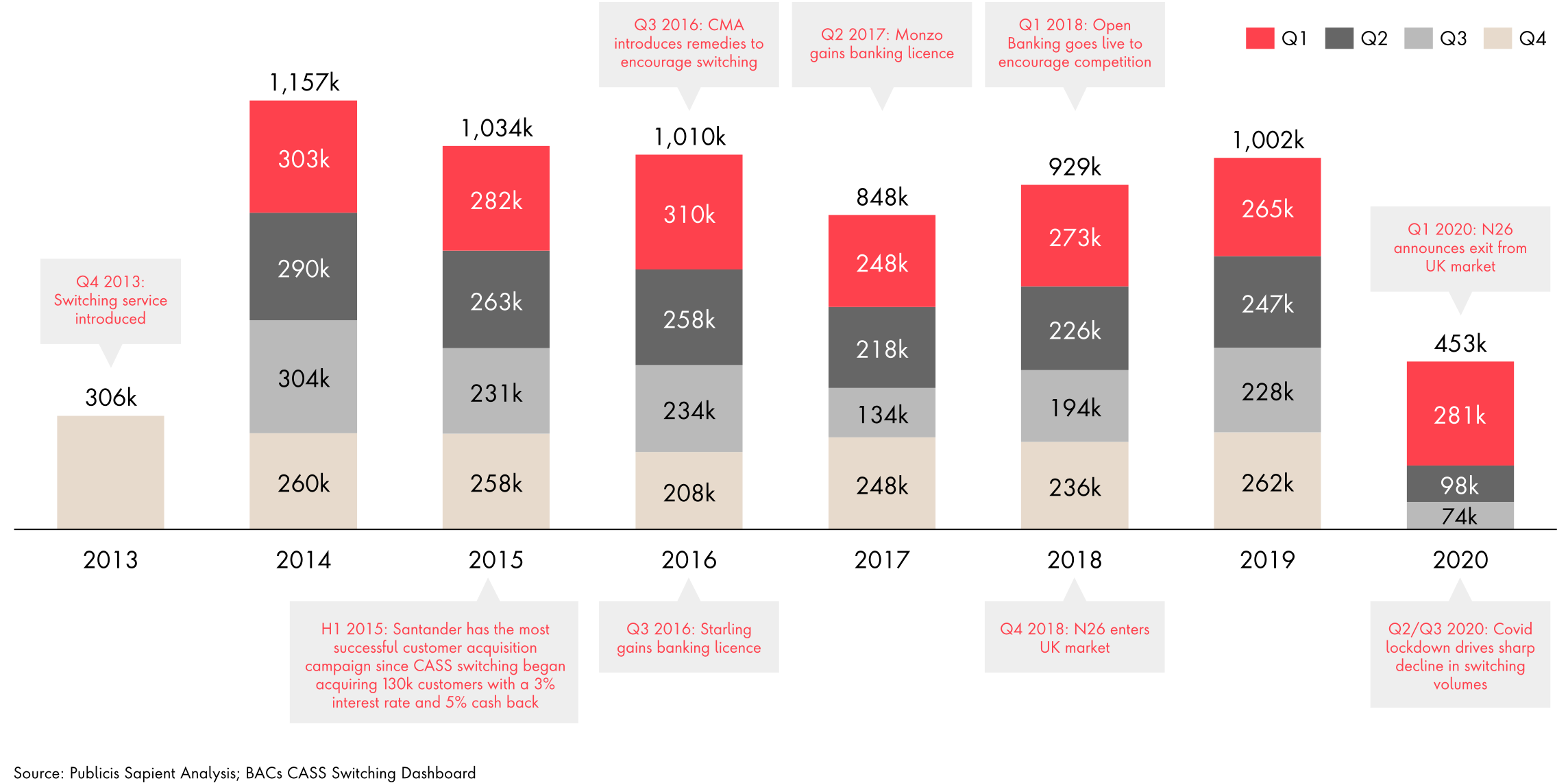

Figure 1: Historic UK switching volumes in decline

The current customer acquisition model doesn’t work, despite regulatory intervention, and new entrants switching volumes are declining.