3. Machines will facilitate constant auction trading for consumer products

With machines managing purchase cycles, the battle for relevance will increasingly move behind the scenes to the digital realm of ultra-high-speed marketplaces. This dynamic becomes very similar to an auction market, like the AI-powered, high-frequency trading that has already transformed stock markets. An example of this can be found by again looking at Amazon and, in particular, their Marketplace Web Service API, which has created its own ecosystem of third-party optimization tools used by suppliers to automatically respond to price changes in order to remain competitive.¹¹

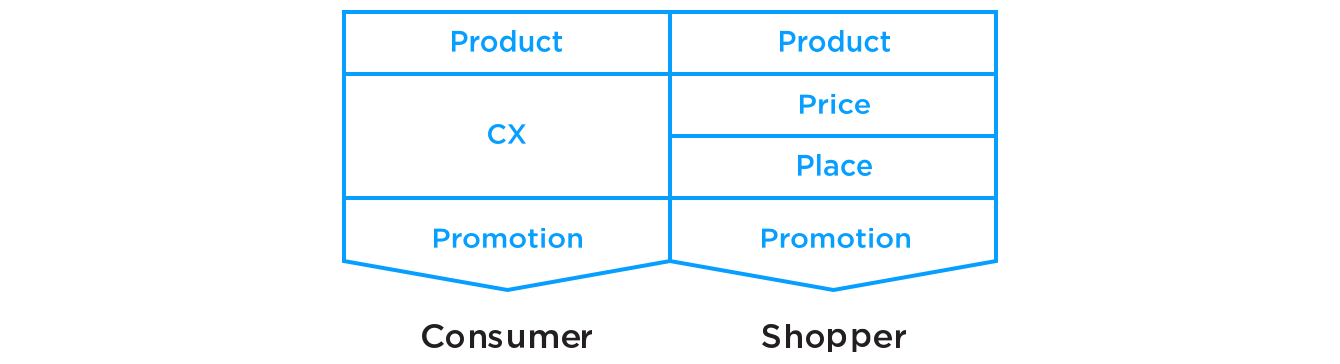

This hyper-competitive, accelerated market setting will likely lead to unprecedented pressure on pricing and margins, and will favor those who effectively meet the specific needs of select groups of customers, as opposed to the traditional mass-market model of meeting the needs of most people. Rather than appealing directly to consumers through branding, advertising, and other traditional forms of promotion, consumer products firms will have to pass the test of the machines first, addressing the barrier of algorithmically powered trading. Critical to this will be understanding the complex mix of data points (e.g., purchase history), preferences, social graph, and product meta-tags that algorithms will leverage to ensure they meet the expectations of their consumers.

From a cultural and organizational point of view, the key step change and transformational imperative is that companies will have to learn how to influence machines’ algorithms rather than the human brain.

4. Products becoming services—becoming platforms—powered by user data

More options and immediate access to cheaper products will challenge the market position of traditional brands. In order to give consumers a reason to stay with them, consumer products companies must learn two things from ecosystem companies: 1) how to become an integral, irreplaceable part of consumers’ lives, and 2) how to solve the direct-to-consumer relationship equation.

In this new landscape, brands must create a complete consumer solution. This will come in different shapes and sizes depending on whether the category in question is low or high interest and if it draws more or less consumer engagement. The key will be offering a value proposition that stems from putting consumer data at the heart of the experience, creating services that do something helpful and add value to expectations in the category and merging connected products or additional digital layers with classic, physical products.

By architecting these valuable consumer platforms, consumer products companies can create a stronger and more independent position in relation to the dominant and incumbent retailers connected to the in-home OS. They can plug these propositions into different operating systems while keeping their core consumer offering and charging a fair price for the added value generated.

5. Consumer products companies becoming responsive networks of value

Today’s landscape necessitates all companies to compete in fundamentally different market conditions. As such, they must explore which assets and levers represent their biggest strengths. Some might choose to win on cost leadership and, therefore, massively streamline their operations to drive maximum operational efficiency. Others might decide that their main source of revenue will come from being private label suppliers and will, therefore, focus on their manufacturing expertise.

However, as part of the transition towards consolidating different business models, big traditional companies will need to fight to leverage the assets they’ve built over time. These players will need to rethink the shape and focus of their internal and external value networks. To thrive rather than survive, consumer products firms will need to look at what new core competencies (agility, responsiveness) and capabilities (automation, big data processing) are needed to successfully “co-evolve” with disruptive ecosystem companies, technologies and other competitive and non-competitive players that make up today’s business landscape.¹²

Consumer products brands must evolve their value networks to focus on establishing key strategic partnerships and joint offerings around various consumer needs and wants. The key will be to scope out opportunities for introducing their own integrations and modularizing existing elements within incumbent systems. Only then will these brands be able to commodify key competitors and capture new value in the market.¹³