The tech titans

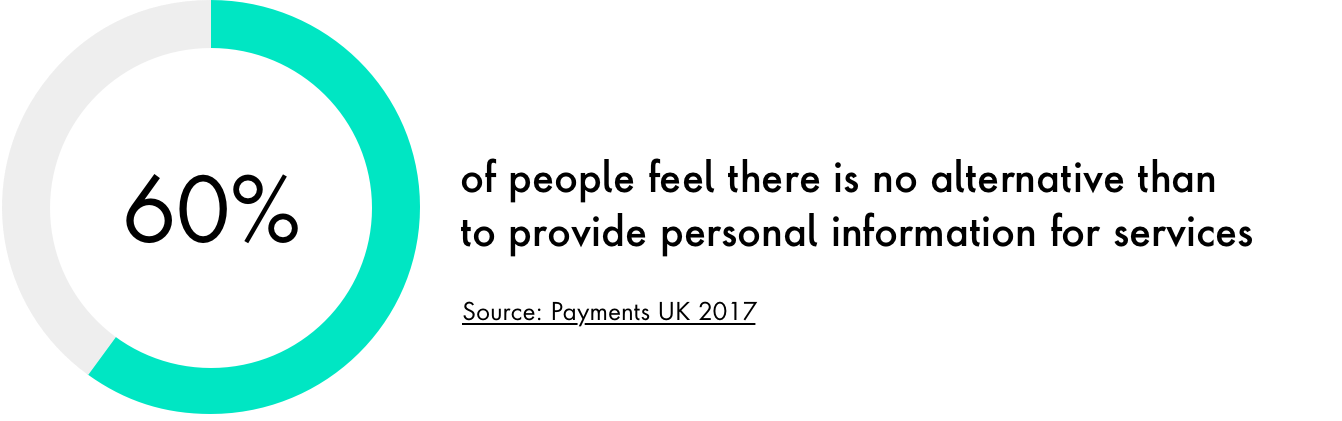

They don't want to become banks and don't need banking licences. Instead tech titans want to gather larger quantities of customer data.

They don't want to become banks and don't need banking licences. Instead tech titans want to gather larger quantities of customer data.

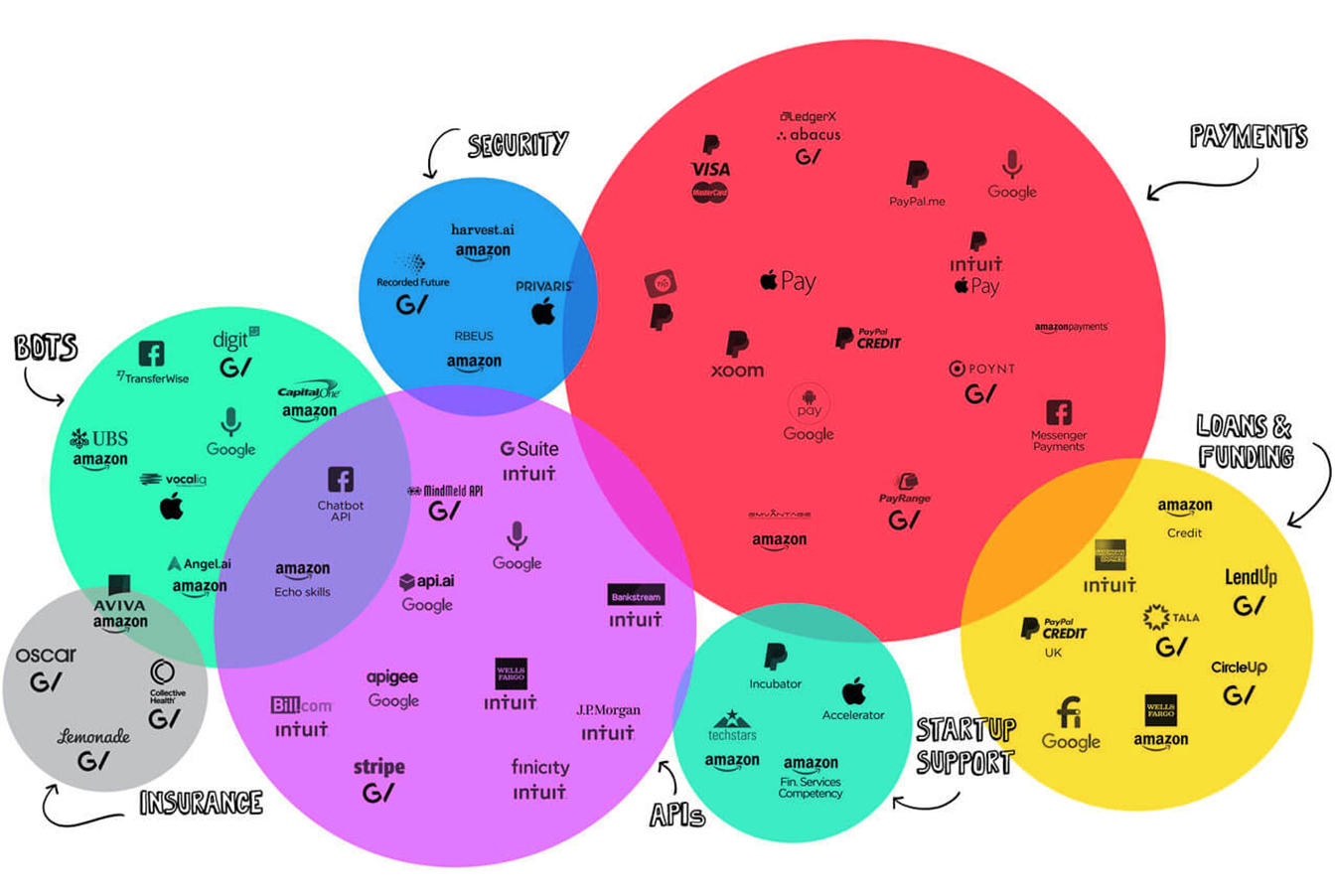

Over the past three years, investment by tech giants and fintechs shows a major focus on digital payments, increasing interest in digital portals (APIs) and a move into cognitive and AI technologies. Here are three ways they aim to compete in the financial sector.

Tech companies want to become the go-to payment option when customers transact. Their focus on payments is giving them an essential role in customers’ lives – and yielding huge amounts of data on their purchasing behaviours which they can then use to generate new insights.

Tech companies are hungry for more and more customer data, are able to interpret it and control the exchange of this data through digital portals (APIs). The data enables these companies to create better services, more targeted advertising and products and pre-empt needs before the customer is even aware of them.

Socially slanted companies (Facebook, Google and Amazon) use their deep experience and understanding of their customers to become fixtures in every aspect of their daily lives. They position themselves as ‘lifestyle partners’ by providing APIs (such as Amazon’s Alexa Voice Service) that offer a personal, tailored interaction with customers.

Amazon employs the 'human touch' via a conversational experience with Alexa, its voice assistant

Facebook's bot API gives startups the tools to provide financial services (budgeting, analysis, advice, etc) - effectively a large part of their banking - via messenger

APIs will supply the technical infrastructure for emerging cognitive technologies – those in control of the API will be in control of the experience.

Related articles