How can Publicis Sapient and Microsoft Azure deliver the Value of Cloud and enable the success of your own Digital Business Transformation?

As discussed, the value of moving to cloud includes inherent benefits to essential enterprise components, however, the greater value lies in its key role in connecting and utilizing your data to swiftly, securely, efficiently and cost-effectively allow your enterprise to remain ever-relevant in the constantly changing mind of today’s consumer. And it just so happens we do this on a daily basis, bringing industry-specific experience, best-of-breed talent and expertise, all while implementing and executing with an unsurpassed global perspective.

In fact, Publicis Sapient and Microsoft have partnered for over 20 years to deliver digital solutions that leverage the best of Publicis Sapient’s unique skill set in digital business strategy, consulting, customer experience, marketing modernization, IT, Data and AI, and deep industry skills, paired with Microsoft’s industry-leading cloud solutions that allow us to generate real business value for our clients worldwide.

So, where do you get started?

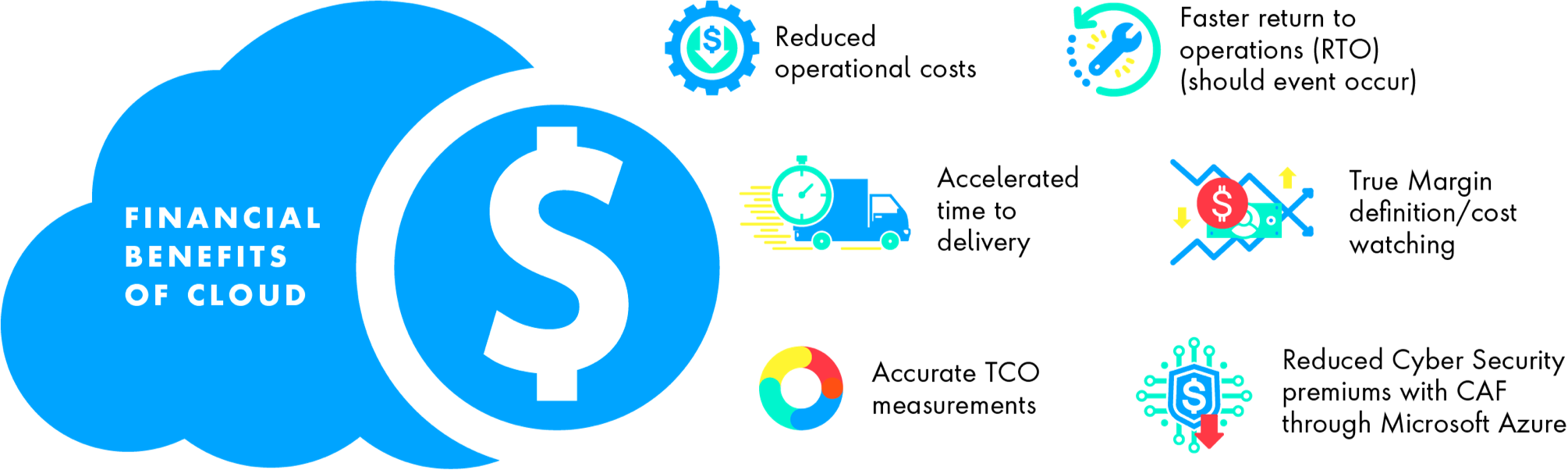

Consider just where you are on your digital business transformation continuum. Are you ready to reduce operational costs and increase your control over profit margins? Are you ready to integrate and manage your environments with easy-to-use tools? Would you like to accelerate developer creativity and time to market? Do you want to improve your security against evolving threats with intelligent threat protection? Wherever you are in your business and digital transformation journey, Publicis Sapient and Microsoft can help you in your evolutionary quest through greater consumer insights and data-driven solutions.

How Publicis Sapient and Microsoft are Transforming the Lending Experience

Together, PS and Microsoft have created a seamless customer journey throughout the lending process, resulting in reducing loan application time and cost per loan by up to 33% and improving end-to-end productivity by 10-15%. At every stage of the application process, customers are better informed and more satisfied with the overall experience.

Able to operate and integrate with any existing systems, Loan Manager can help at every stage of the lending journey, including: communication, documents, data, process and management information (MI).