The popularity of point-of-sale (POS) finance options has grown significantly, leading influential market players to focus on checkout finance and offer credit alternatives such as "Buy Now, Pay Later" (BNPL). This response is driven by changing consumer behaviors influenced by emerging retail trends.

The rapid expansion of the BNPL model is currently driving unsecured lending. This payment method has emerged as a compelling choice, particularly among Gen Z and millennial consumers who are actively shaping the future of shopping. Its appeal lies in its interest-free credit structure, simplified approval processes and convenient fixed payment schedules, making it a preferred option over traditional credit cards. Clearly consumers value BNPL. So, what’s next for merchants and providers?

As the latest digital wave in financial services, BNPL is looking to disrupt the traditional credit card model. In the U.K., card-linked installments have emerged as the dominant choice for new entrants aiming to swiftly capitalize on market opportunities. These offerings bear similarities to BNPL but leverage the existing Visa or Mastercard infrastructure utilized by banks for their card businesses. However, this business model does not facilitate customer acquisition efforts and may result in the cannibalization of banks' existing credit card business with lower profit margins.

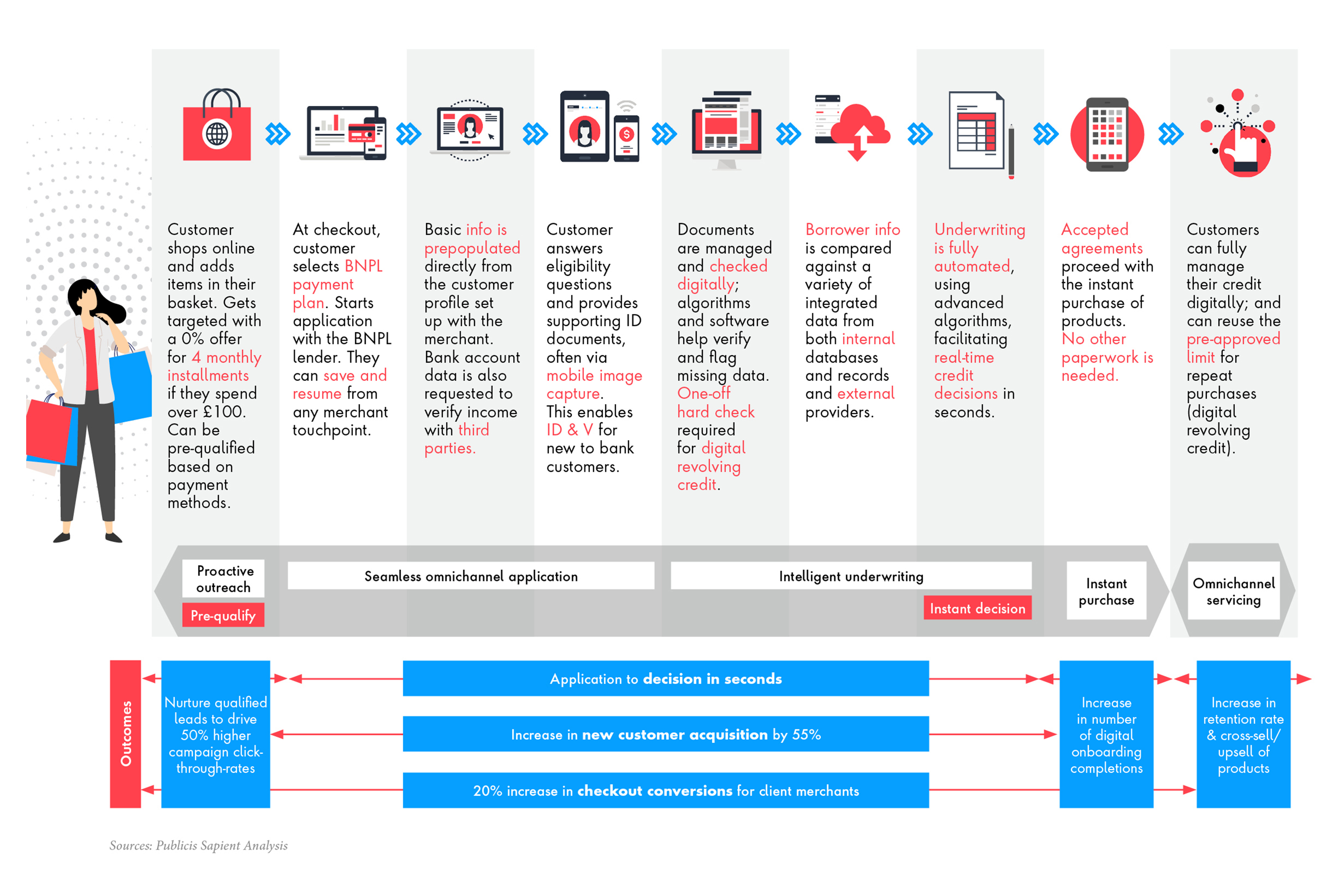

BNPL is at the forefront of embedded finance, where a loan product seamlessly integrates into the customer journey of a partner company, rendering the finance provider invisible to the customer. This integration enables financing to be provided at the most suitable moment, reducing friction, enhancing the customer experience, fostering loyalty, lowering customer acquisition costs and generating greater lifetime value.

Nevertheless, it is important to acknowledge that merchants typically establish relationships with only one or two BNPL providers, and, once these relationships are established, they tend to be long-lasting. Consequently, entering the domain of "embedded" BNPL involves intense competition. Banks interested in entering this market need to act swiftly to secure their position.

As BNPL continues to see rapid growth, particularly in e-commerce, providers are grappling with several challenges in an unregulated environment. One major concern revolves around the potential harm to consumers who may be unaware of the risks associated with accumulating debt. To tackle these issues, efforts are being made to bolster regulations and introduce effective control measures in the industry, aiming to mitigate the risks and protect consumers. This recognition of the need for stronger regulations indicates that the current BNPL 1.0 model is not sustainable in the long run. But what does the next wave of BNPL look like?

BNPL 2.0 represents a safer and fully regulated alternative that promotes responsible lending practices. With the implementation of BNPL 2.0, merchants can offer an embedded and personalized checkout experience, leading to significant growth through improved conversion rates and cost-effective customer acquisition strategies. This regulated approach ensures that lending practices align with consumer protection measures while still providing the convenience and flexibility of installment-based payment options. By adopting BNPL 2.0, merchants can enhance their business performance and provide customers with a secure and tailored checkout experience.

What We Do

You want to grow, modernize, stay relevant and delight customers. We partner with you to achieve your goals and create impact through AI-powered digital business transformation.

back

What We Do- Industries

- Solutions Solutions All Solutions

-

What We Do

You want to grow, modernize, stay relevant and delight customers. We partner with you to achieve your goals and create impact through AI-powered digital business transformation.

-

-

About Us

Curious? Get to know us a little better.

-