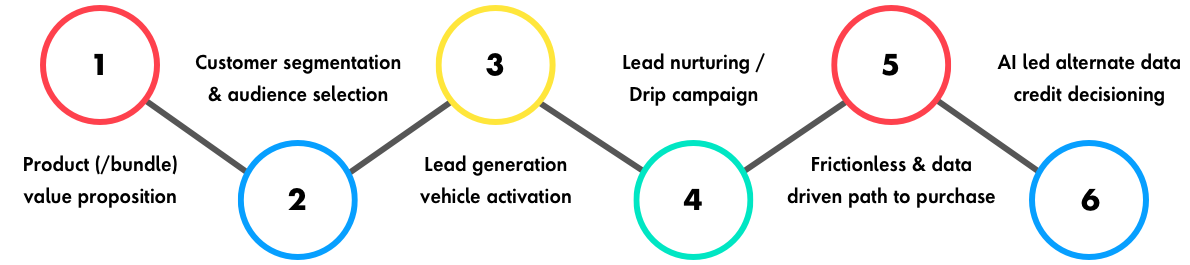

1. Product (/bundle) value proposition:

- Conduct quantitative and qualitative research to identify product (and/or bundle) value proposition.

- Use a third-party customer database like Epsilon, which captures demographics, psychographics, lifestyle, interests, hobbies, propensity and financial habits to understand customer needs and micro-segment them.

- Extend this learning with social media listening and analytics to understand customer segment preferences, likes, dislikes, unmet needs, and more.

- Conjoint analysis is extremely helpful in providing insight into how customers prioritize different needs. Set up digital conjoint analysis questionnaires (via Qualtrics and other tools) and administer them to recruited participants who meet the criteria for the customer segments.

- Supplement the quantitative research with qualitative ethnographic research.

2. Customer segmentation and audience selection:

Accurately identifying people drives everything. Create a digital identity solution that ties customer data across devices and sites. Develop a deep understanding of the customer employing digital identify and third-party customer databases to gain insights of customers like:

- Who am I: Demographics and lifestyle

- What I buy: Online and offline purchases

- What I watch: Broadcast and digital consumption

- What I browse: online interactions

- Where I go: Location and proximity intelligence

- How I connect: cross-device information

Conduct micro-segments modelling to identify high propensity audience and value-pool analysis to identify segment’s worth.

3. Lead generation vehicle activation and measurement:

Use customer intelligence and real-time decisioning to activate across paid search, paid / owned social media and affiliate sites and gain a closed loop measurement of the effectiveness of each of these vehicles.

4. Lead nurturing and drip campaign:

- Get prospects to engage with you using content that speaks to their needs and context. Optimize the landing page and provide clear CTAs.

- Employ marketing automation platforms like SFMC/Adobe to create event driven journeys.

- Employ a personalization engine to determine the next best content for the prospect based on their actions with your online and offline channels, preferences, outside shopping behavior, etc.

- Personalize the content journey depending on where the visitor is clicking from (e.g., affiliate site, search engine, direct to the website, etc.)

- Know when customer is physically and mentally available for contact and reach at the right time via right channels using customer availability AI, this is especially relevant when an offline phone contact is required as part of the nurturing journey.

5. Frictionless data-driven path to purchase:

- Redesign website and customer journeys using human-centered design.

- On an ongoing basis conduct data driven optimization (DDO) and experimentation - Use a measurable approach to rapid and iterative experimentation and ongoing optimization enabling your bank to learn, make decisions faster and confidently, and compound on improvements over time. Data-driven optimizations range in type and size (e.g., new features, CTAs, value props, pricing, page flow, forms, navigation and templates).

- Experience leaders employing DDO showcase three common trends:

- Ability to derive customer insights from data

- Ability to react and act quickly

- Ability to innovate through experimentation

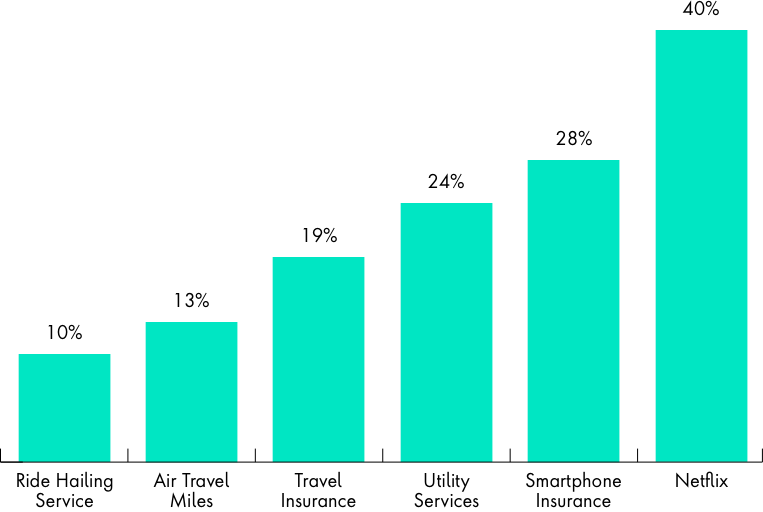

In 2016 when Netflix CEO Reed Hastings was asked where he sees Netflix in five years, he said, “We really don’t know. It's not Netflix that's making the changes. It's the internet. We're figuring out every year how to use the internet to make a great consumer experience. Every year is an experiment.”

- Enable human connected digital experience with chat, co-browse to intervene when visitor is detected to drop out from your website. Using human chat/co-browse has shown to recapture 10 to 20 percent of the likely digital funnel drop out candidates.

Even with a best-in-class experience, some drop-offs are inevitable, so re-engagement campaigns must be data-driven, personalized and hyper-relevant.

- Effectively re-engaging customers who drop off the funnel is essential to improving conversion and requires robust data collection, automated personalized campaign activation and thoughtful content

- Drip campaigns should be tailored to where in the funnel a visitor drops off and what we know about them (through data collected, visit behavior and personal profile)

- The closer to the top of the funnel a customer is when they drop, the more the campaign should focus on digital intervention. The closer the customer is to the bottom of the funnel, the more the campaign should focus on human intervention. Of course, there are always exceptions for high value customers with complex needs that require human intervention to close.

6. AI-led alternate data credit decisioning:

When it comes to lending, banks have predominantly relied on FICO scores which are backward looking and don’t provide a good assessment of a willingness and ability to repay. A large segment of the underbanked segment is the USA does not have a long enough credit history for FICO. But many of these individuals are credit worthy. Banks are leaving money on the table by declining credit to these customers based on FICO. Banks can use advanced forward-looking alternate data-based credit decisioning to maximize lending conversion while reducing defaults at the same time.