That means a bank’s technological, cultural and philosophical changes should establish several relationships with the customer for a holistic experience. In other words, banks shouldn’t settle for providing one customer with a single service when totality is possible.

Growth in context

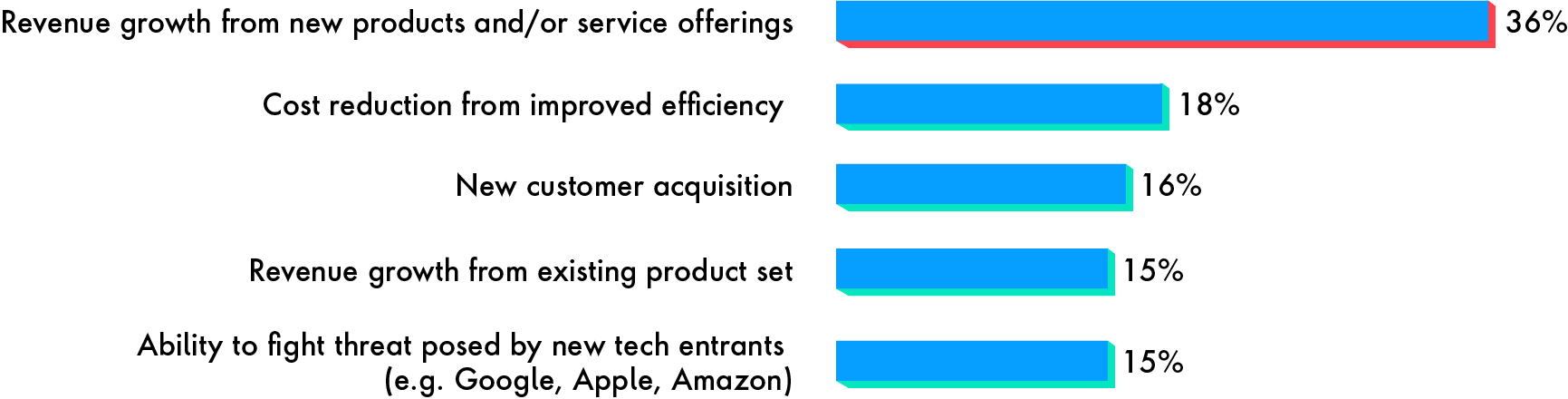

For teams tasked with driving growth, it’s important to gauge where their mission stands in relation to other digital-transformation goals.

Publicis Sapient teamed up with Longitude, a Financial Times company, to create the Global Banking Benchmark Study, which helps financial institutions better understand how digitally transformed they are compared with the rest of the industry and how to compete with digital natives, big tech companies and digital-first rivals.

More than one thousand finance executives across 13 countries participated in the survey. At one point, they were asked which digital transformation goal was most important to their company – revealing the general mindset of the financial services industry.