It might sound like a truism that businesses should be focused on fulfilling the customer’s needs, but it’s still uncommon. Mamania said wealth management firms should scrap thinking in terms of verticals and instead create pods dedicated to specific customer segments.

“If we can understand the background and context of different customer segments, we can figure out what their needs are. We can personalize experiences and what we’re pitching to them based on that, ”Mamania said.

He said organizations need to make sure they are capturing data from all channels – both on and offline. For instance, all of the events that happen when someone walks into a financial center are important, including whether a customer talks about mortgages, deposits a check at the teller or withdraws cash at the ATM.

“All of these facts give us signals, and those collected signals describe intent. The more robust and holistic we can make that dataset, the better intent and context we can derive, ” Mamania said. “The CDP helps collate the information from all of these channels, aggregate it and put it in a consistent fashion.”

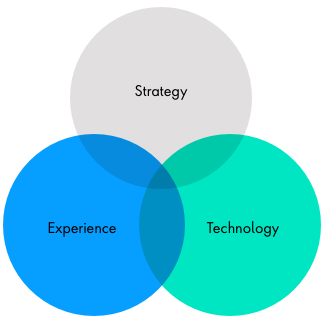

Chakraborty added to actually convert more leads, the salesforce will need to adopt a whole different set of methodologies: improve internal operations, create more agile teams and privilege pods over separate business verticals.