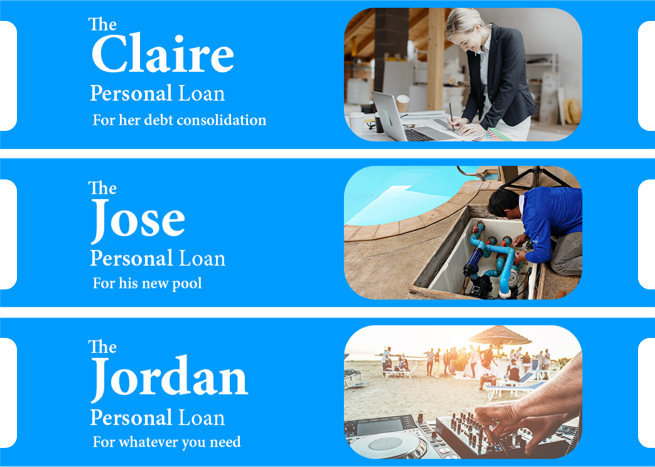

Two-thirds of customers today expect their banks to know their needs, deliver personalized engagement and tailor offers exclusively for them. But many lenders continue to drive a non-personalized approach to customer acquisition, with irrelevant offers and one-size-fits-all comms. The result? Low conversion rates and dissatisfied customers.

Five years ago, that would have been shortsighted. But today, with new digital-savvy fintechs driving growth in consumer loans, lenders without a customer-centric engagement strategy are facing a big problem.