AI and machine learning give banks the power to better understand banking patterns in the digital world and more efficiently target their most likely future customers.

Customer segmentation is the process by which marketers seek deeper understanding of their existing customer base. It’s also the fundamental – and perhaps most important – way marketers can put all their customer data to work in service of achieving growth objectives. Practically speaking, it’s how banks can go from just having rich customer profiles to delivering personalized offers and experiences. That’s why customer segmentation is important for banks.

But most banks struggle to find the right balance of precision in customer segmentation: go too broad and you lose relevance and risk making the wrong offer to the wrong person at the wrong time; aim too narrow and it becomes too difficult to scale. To be fair, this is a longstanding challenge and might be a never-ending journey. After all, until we reach the state where every marketing message and promotional offer is 100%-personalized, customer segmentation can always be just a little more precise.

Banks are thinking bigger on customer segmentation

In the age of hyper-personalization, banks are both re-thinking customer segmentation and expanding its parameters. Certainly, most banks can go deeper by understanding, for example, not just which products customers have, but also their lifetime value. Further, banks can seek to know how customers behave at each phase of the customer journey and their unique banking patterns in the digital world.

But the end goal is not simply to categorize or tier existing customers by value or other useful metrics. Rather, banks should seek insights and intelligence to expand the addressable market beyond the existing customer base by identifying where demand most likely already exists. Then they can use customer segmentation to transform the banking experience.

Reversing the funnel: Customer segmentation with AI and machine learning

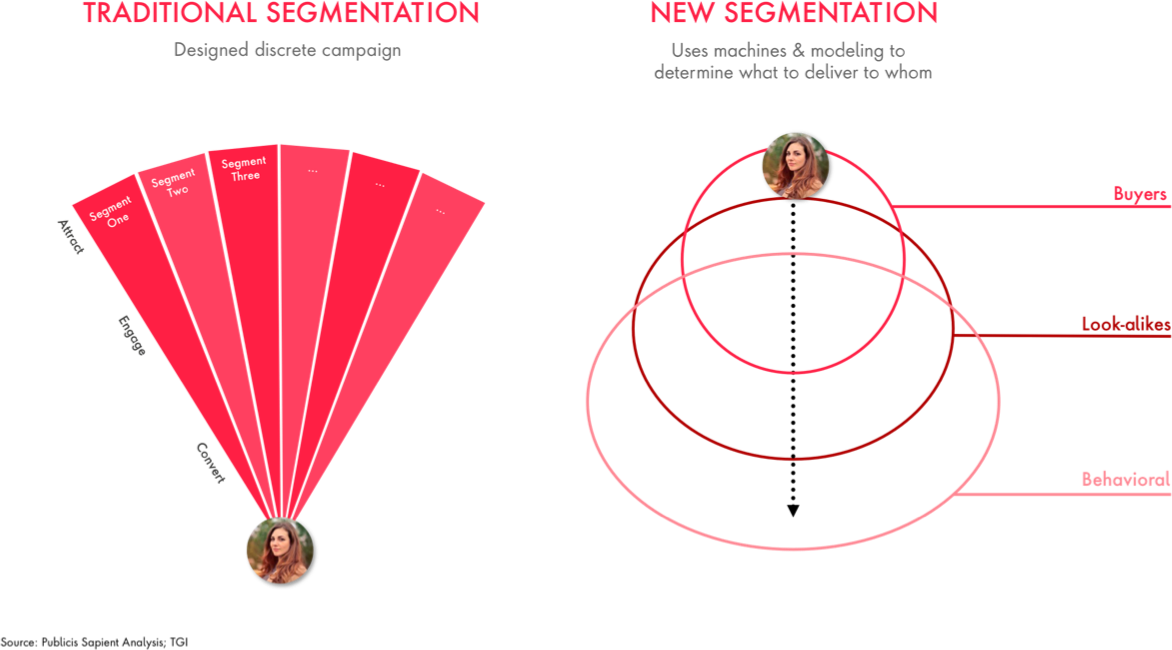

But whatever we call it, banks that use artificial intelligence (AI) and machine learning will gain a big advantage. Because effective segmentation is a function of the amount and quality of data available, AI and machine learning give banks the firepower they need to process and analyze massive amounts of data. AI-based tools can crunch huge quantities of data (e.g., first-party data) and identify anomalies and patterns within raw behavioral data that indicate propensity to buy.

In that sense, it allows marketers to reverse the traditional marketing funnel based on the ability to find lookalike customers. Instead of sharing one message with as many people as possible in an attempt to generate demand, companies can identify where demand already exists by discovering non-customers who, through patterns of behavior, demonstrate a likelihood to buy.

That means banks can tailor messages and offers to smaller sets of customers, rather than starting with one-to-all or one-to-many messages at the top of the funnel. And the more and better the data AI tools can analyze, the more and better insights they will generate – an important consideration given the pending loss of third-party cookies.

AI makes the identification of such lookalike consumers much more efficient and accurate. Lookalikes – an increasingly valuable commodity in the eyes of marketers – are those individuals who demonstrate behaviors similar to existing customers and are therefore considered the easiest (and most affordable) to acquire as actual customers.