Indeed, first-movers and early adopters are already working to innovate across all of their channels – from the most traditional to the leading edge:

- High-tech branches are designed to be more welcoming, to support a wider range of products and services, and to provide easier access for customers.

- Banks are engaging customers via social media with useful content on important topics (e.g., saving money and budgeting).

- As wearables facilitate contactless payments, banks are establishing the tech infrastructure and partnerships to enable payments and other basic transactions.

- With the maturation of smart speakers, leading brands (in banking and beyond) are already deploying conversational AI and voice bots to field basic inquiries and share product information with automated prompts and connections to human support when necessary.

- Because call and contact centers remain vital resources for large numbers of customers, banks are implementing digital customer engagements in these contact centers, for agents to seamlessly engage with customer on Website or via an inbound call using co-browse, chat, audio and video.

- Video banking has emerged as a viable and cost-effective way to support customers securely, conveniently and with a human touch, while also boosting the productivity of financial advisors and private bankers.

- Virtual and augmented reality and the metaverse are the next horizon for banks – and not just for customers who want to transact in crypto or other digital currencies. Leading banks are establishing branches in the biggest virtual worlds and seeking the right partners.

Omni-channel in the short and long terms

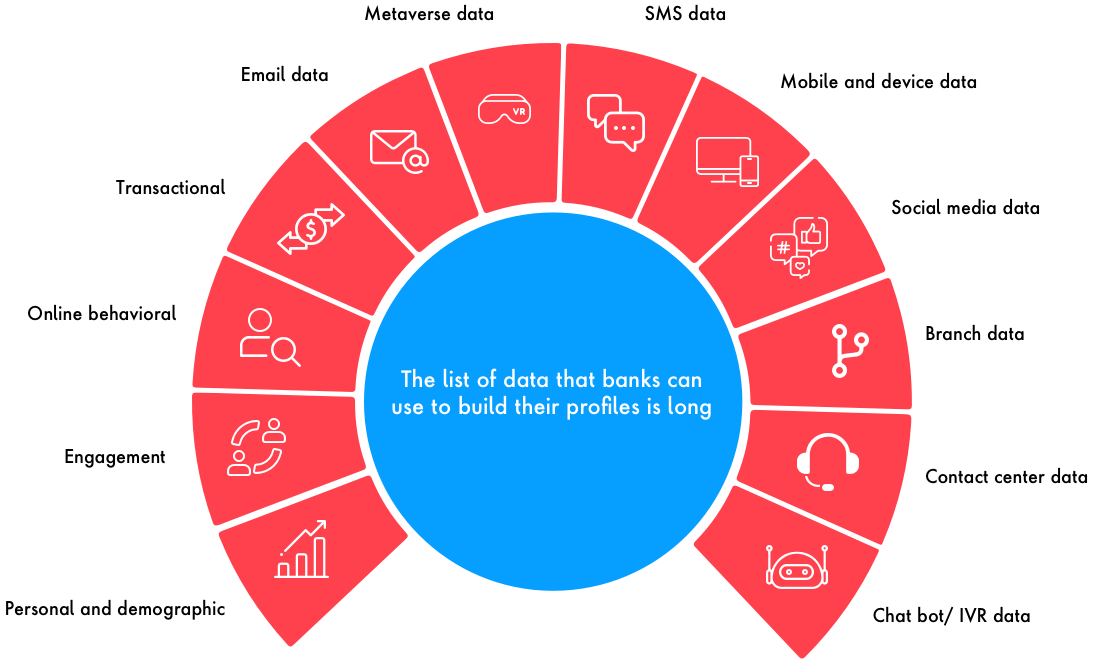

The imperative to devise strong omnichannel strategies and execute them flawlessly will only grow more urgent as customers continue to engage their banks in even more ways (e.g., in the metaverse, on social media, via smart speakers, virtual assistants and wearable devices) in the near future. History shows that customers continue to adopt new channels of engagement without leaving traditional channels. That is a primary challenge for banks when it comes to omni-channel.

Open banking is another powerful, long-term force that will make omni-channel a critical capability. When consumers control their own data and platforms make it easier for them to find the providers they want to work with, the stakes around individual interactions will rise. Traditional banks will find themselves competing with new competitors that delight customers with personalized solutions that build trust and never, ever require re-entering personal information.

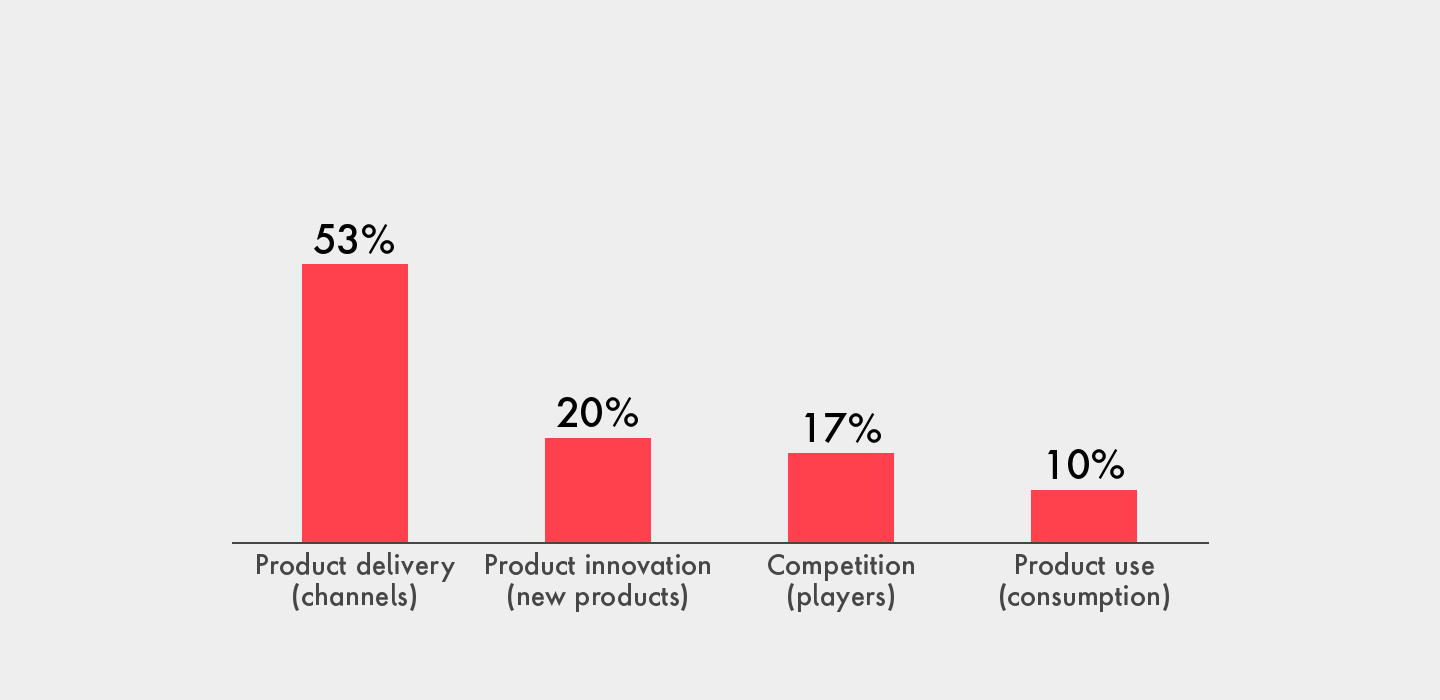

As much as technology is essential to winning with omni-channel, there’s a cultural dimension that bears mentioning. Fundamentally, the move from multi-channel to omni-channel represents a shift away from product-centric thinking to truly customer-centric experiences. It’s unifying all interactions and touchpoints, rather than offering fragmented transactions in standalone channels.

The bottom line: Banks need to get better at creating, curating and managing personalized, omni-channel experiences for all of their customers. That’s no easy task, given how much effort and investment is required. But, in the age of personalization, omni-channel capabilities are the front – actually, the many fronts – where incumbents will win or lose. we believe linking them together seamlessly is essential for future market leadership in banking.